Unless you want to move back home, you’re likely going to face the buy versus rent decision and it’s not an easy one! There are actually two decisions to be made – can you buy and should you buy?

There are a million variables you could consider – check out this incredibly detailed calculator from the NYTimes for example. Overwhelmed yet? We’re going to take what can be an incredibly complex decision and boil it down to the most important factors – something everyone can understand.

Table of Contents:

Why it’s critical to think 5 years out

Why does Yoreevo suggest owning property for 5+ years if buying?

Doesn’t NYC real estate appreciate more than 2% per year?

What are the financial requirements to rent versus buy?

Comparing monthly payments for buying versus renting

Capital gains – an under-appreciated advantage of buying

So why rent versus buy?

Tilt the scales towards buying with Yoreevo

Why it's critical to think 5 years out

A lot of people decide to buy as soon as they can afford it but there are a number of lifestyle factors that often go overlooked. Buying your home feels like an accomplishment (and it should!) but it also incurs significant transaction costs and exposes you to risks renters avoid.

We’ll get into the numbers but first, you need to take a hard look at your living situation today and think about how it may change over the next few years.

Buying and eventually selling an apartment is really expensive. All in, if you’re buying the average NYC apartment with a traditional broker, your total transaction costs will be about 10% of the purchase price. If you would like to dive into the details, check out our buyer closing cost guide and seller closing cost guide but regardless of the details, it’s very expensive to buy and sell an apartment.

For that reason, by far the #1 factor in your decision to rent versus buy is how long you are likely to live in the property. Remember it’s going to cost you about 10% to get in and get out so if the property’s value does not go up at least that amount, you lose money.

What are some factors you should consider when determining how long you’ll be there?

- Will your household grow? If you might get married, have kids, get a big dog, etc, you’ll probably need a larger apartment.

- Do you love the neighborhood and NYC? Remember you should plan to live in the property for at least five years. If you might get sick of a neighborhood or want to move to the suburbs, buying might not be a good fit.

- How stable is your job, both generally and geographically? If you buy, you’re locked into 30 years of mortgage payments so losing your job can be especially tough. Relocating would also likely force you to sell and incur significant transaction costs.

Why does Yoreevo suggest owning property for 5+ years if buying?

Making money on your home is great but first you need to break even. What’s a realistic expectation for how long that will take?

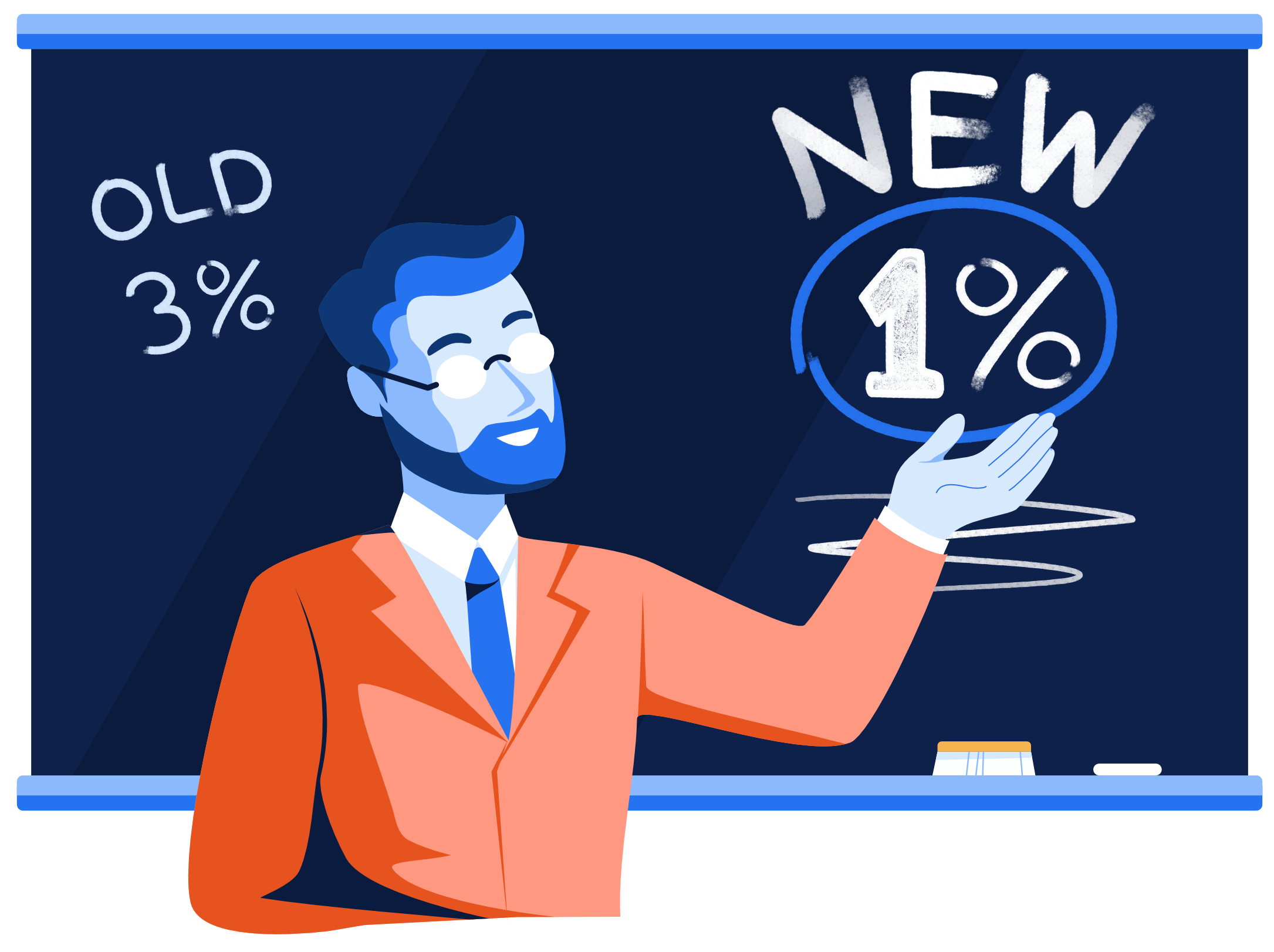

Yoreevo believes expectations of appreciation over 2% (normal inflation) becomes speculation and your home should not be a speculative investment. Assuming transaction costs of 10%, you’ll need about five years before breaking even at 2% appreciation per year.

Of course we have to mention that if you buy and sell with Yoreevo, your transaction costs will be much lower - about 40% lower actually - so you breakeven much sooner!

Doesn’t NYC real estate appreciate more than 2% per year?

This is one area where Yoreevo disagrees with a lot of people. In fact, we just got a newsletter from a very successful agent that pointed out that NYC real estate has appreciated 7% per year over the last 70 years. The implication was you should buy because that’s a great return. 7% appreciation for real estate isn’t just great, it’s incredible! Unfortunately, it’s not at all realistic.

You’ve probably heard the standard mutual fund disclaimer “Past performance is no guarantee of future results” - it applies here too.

If NYC appreciates at 7% for another 70 years, the average Manhattan apartment will go from $2 million to $23 million! Possible? Of course. Likely? No way!

To assume 7% appreciation going forward is like saying since Amazon went up 400% over the last five years that it will go up 400% over the next five years. If only investments were that easy!

What are the financial requirements to rent versus buy?

Now that you’ve decided if you should buy, it’s time to figure out if you can buy and how much you can afford.

Everyone is familiar with landlord requirements. They’re pretty simple - make around 40x the rent or find a guarantor and you’re in business. Buying gets a little more complicated.

If you are buying a condo or a house, your bank will set most of the requirements. Very generally, expect to put down at least 10% and have a debt to income ratio under 43%. Co-ops will have stricter financial requirements. While every building is different, they’ll usually require 20% down, a debt to income ratio under 30% and post closing liquidity of 12-24 months.

If you’re not sure whether you should be looking at condos or co-ops, feel free to contact us and/or check out our dedicated condo versus co-op post.

Comparing monthly payments for buying versus renting

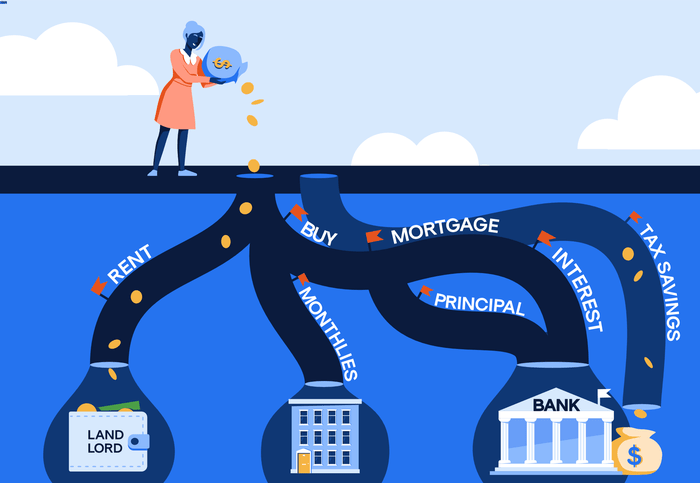

Monthly payments are a big part of the buy versus rent math but comparing them isn’t so straightforward and requires some adjustments.

Rent is the simple side of the equation. All of your rent is a pure expense every month. You pay your landlord and the money's gone.

When buying, there are a few monthly payments and you need to break them down.

Mortgage - Your mortgage is made up of principal and interest payments. Principal goes to paying down the loan and interest is the cost to borrow the money.

- Principal - While it’s a cash cost, is not a real cost. It’s more like forced savings. Dollar for dollar, you principal payment pays down your loan and as your principal goes down, your equity (ownership) of the property increases. In Yoreevo's opinion, this should be removed when comparing monthly payments.

- Interest - This is similar to rent in that it’s a real expense and once it's paid, it’s gone. The bank is just standing in for the landlord. But because interest on the first $750,000 of principal can be written off on your taxes, you need to look at this payment “after tax.” To do that, you multiply it by one minus your tax bracket. For example $10,000 of interest paid by someone in the 32% tax bracket would effectively be $6,800 because they would avoid paying $3,200 in taxes.

Building Payments - If you’re buying a condo, you’ll get two bills - common charges for the building and property taxes for your unit. A co-op will lump these two together in one maintenance payment. For a house, you’ll get your property tax bill and everything else is up to you - you’re the boss in your own house! For simplicity’s sake, assume all of the monthly building payments are like rent. In certain situations there can be adjustments for property taxes but due to 2017’s tax reform, they will not apply for most buyers.

Capital gains - an under-appreciated advantage of buying

Everyone knows interest payments are tax deductible (to an extent) but the IRS does home buyers another big favor in the form of the capital gains exclusion for primary residences. As long as you have lived in the property in two of the five years before you sell, you can avoid paying taxes on $250,000 of capital gains or $500,000 if you’re filing with your spouse.

The exclusion especially beneficial for NYC buyers because property values are so much higher than the rest of the country. Making $250,000 on a property is a lot more likely on a $1,000,000 property than a $250,000 property.

The capital gains exclusion is something most buyers aren’t aware of until they actually sell but it’s huge! Compare it to long term capital gains at 15-20%. All else equal, an individual would save about $40,000 on taxes by investing in their primary residence over stocks.

The tradeoff is not that simple and something you should leave to a financial planner but the IRS certainly tilts the scales in favor of home buying with this significant exclusion.

So why rent versus buy?

Most of this post has been pretty favorable towards buying and for good reason. If you’re at the right point in your life and qualify financially, the tax code gives buying a lot of advantages. But there are plenty of reasons why renting over buying makes sense.

Renting is simple and flexible. You pay your rent and that’s it. Leases are typically a year and if you want to leave beforehand, you can probably sublet. If something breaks, your landlord fixes it.

You also can adjust your living expenses as your life requires. If you’re renting a fancy apartment and lose your job, you can move into something more modest. When you have a mortgage, that’s not an option.

Renting can also be the smart financial move when rents are low relative to home prices. The housing crisis taught everyone home prices can get too high and eventually come down. There's also risk investing a significant chunk of your savings in one asset, even if it is your home.

You also face unexpected expenses as a homeowner. If your roof leaks, you have to fix it. Basement floods? That’s a problem. Condos and co-ops also can implement assessments for similar urgent fixes.

While renting doesn’t have the upside, choosing to rent versus buy significantly lowers risk and provides greater flexibility.

Tilt the scales towards buying with Yoreevo

If you would like to dive into your particular situation, please contact Yoreevo and we’ll go into the real nitty gritty. Two of Yoreevo's co-founders worked in finance before starting the company and did all of this math and then some before they decided to buy a few years ago.

On top of helping you figure out the rent versus buy equation, Yoreevo will save you money regardless of which route you go. Our commission rebates work on both purchases and rentals. By buying and selling with Yoreevo, you’ll reduce your transaction costs by about 40%.

Note: The examples used in this post are high level and involved assumptions that may or may not apply to your situation. We are happy to discuss your particular details but also suggest talking to a qualified accountant. This post is not meant to be tax or legal advice.