One of the first steps in buying New York City real estate is picking an agent. Experienced? Check. Trustworthy? Check. Personable? Check. Do they offer rebates? Ummm, what?

If you've never heard of buyer agent commission rebates, you're not alone. They’re the big secret the real estate brokerage industry doesn’t want you to know about — and they can save you a ton of money. To be more specific, over the last eight years, Yoreevo’s buyers have received an average commission rebate of $24,474 and over $16 million in total!

Those renovations you wanted to do? New furniture? A buyer rebate can go a long way towards paying for part or even all of that so let's make sure you get one!

How Are Real Estate Commissions Paid in NYC?

Before explaining how commission rebates work, you need to understand how commissions are paid.

In a typical transaction, the listing agent charges the seller 2.5-3% and the seller expects to pay the buyer’s agent another 2.5-3% for a total commission of 5-6%.

A buyer can pay their agent directly, but we’ve never seen it. Instead, a buyer’s offer includes that the seller will pay the buyer’s agent a specific commission. Despite the 2024 NAR settlement, the buyer’s agent commission tends to be what the seller is offering and expecting to pay.

Crucially, even if you don’t use a buyer’s agent, a second commission is still paid. The listing agent usually charges the seller an additional 2.5-3%, the commission that would have been paid to a buyer’s agent.

With the commission being paid either way, this is where buyer agent commission rebates come in.

What Are Buyer Agent Commission Rebates in NYC?

A buyer agent commission rebate is simply when a buyer's agent gives part of their commission to the buyer.

The rebate can be any amount — that's between you and your agent.

These refunds are also called “commission rebates,” “buyer rebates,” “broker rebates” or “buyer broker rebates” and the mechanics are very simple. The buyer can either receive a check at closing or have it applied as a credit to the transaction.

Are Commission Rebates Legal in NYC?

Of course, commission rebates are legal in NYC! Not only are they legal, the New York Attorney General's office encourages their use as a way to promote competition.

By working with an agent who gives you a buyer agent commission rebate, you effectively pay less.

For example, say you buy an apartment for $1,000,000 and the seller is offering a 3% commission. Your agent will collect a $30,000 commission but the rebate reduces your agent's compensation and lowers your effective price. In this case, a Yoreevo buyer would receive $17,500.

Commission rebates are legal across most of the country. There are a few states holding out but they're falling. For example,

- In 2021, Louisiana legalized commission rebates

- In 2022, Oregon made it clear that rebates can be applied as transaction credits

- In Iowa, their status isn't clear and but Iowa's Association of Realtors said in this 2021 interview that they're generally okay as long as they're disclosed

If you are in a state where commission rebates are illegal, call your representatives and ask. If they have a good answer, we'd love to hear it!

Are Commission Rebates Taxable?

The short answer is no. The IRS issued a private letter ruling in 2007 which treated a commission rebate as a reduction of the purchase price. If we take our hypothetical $1,000,000 apartment with a $17,500 rebate, the IRS would say you paid $982,500.

On a related matter, buyers often ask if they'll receive a 1099 for their commission rebate. Since the rebate is not considered income, they do not.

While a private letter ruling is not a universal rule, we are not aware of any commission rebates that have been taxed. That being said, it's always smart to check with your accountant.

How Do Agents Feel About Buyer Rebates?

To answer this question, we need to break the traditional agent community into two buckets.

Listing Agents: Any smart listing agent will realize that a rebate is great for them. What the buyer’s agent does with their commission doesn't affect them whatsoever. The listing agent's commission will be exactly the same and with a rebate, it's easier to get a deal done. Their $1,000,000 listing now only costs $982,500. Everyone wins!

Traditional Buyer Agents: Understandably, traditional buyer agents are sometimes threatened by commission rebates. Nobody likes making less money. In order to justify their high commissions, traditional agents often associate price and value with something to the extent of, “You get what you pay for.” But does that agent do less work if they’re getting paid 2.5% instead of 3%? “Of course not!” they'll tell you.

Rather than cling to the status quo, Yoreevo is embracing technology to reduce costs, increase efficiency and pass those savings on to our buyers.

How Do I Negotiate Buyer Rebates in NYC?

Any NYC real estate agent or brokerage can provide a buyer rebate. That being said, most agents don't want to reduce their commission. They may even be insulted if you imply they’re not worth the full commission.

An agent's brokerage can also be a problem. They often have minimum commission rates, eliminating the opportunity for their agents to provide a rebate.

The easiest approach is to work with a real estate brokerage that openly offers rebates like Yoreevo. That way, you’ll know exactly how much you’ll get back without any negotiation or awkward conversations. Yoreevo's business model is built on lower commissions so we're happy to have you as a client and get you a rebate!

Regardless of who you work with, make sure you get the rebate in writing to protect yourself and make sure everyone is on the same page.

What Are Some Possible Issues With Buyer Rebates?

The only issue you can potentially encounter with a buyer rebate is its effect on the loan-to-value (LTV) of your mortgage. If the rebate is not factored into underwriting, your LTV could be too high but as long as you tell your lender, everything will go smoothly.

For example, say you are buying a home for $1,000,000 and the bank requires 20% down. You’ll contribute $200,000 and borrow $800,000 — seems simple. However, the rebate is generally treated as a reduction of the purchase price. If you're getting a rebate of $17,500, the bank will now say you're getting an $800,000 loan on a $982,500 purchase and your

LTV just increased to 81.4% ($800,000 / $982,500).

Why Aren’t Buyer Agent Commission Rebates More Common in NYC?

More buyers are learning about commission rebates every day but unfortunately most have no idea they exist! There are a couple reasons why.

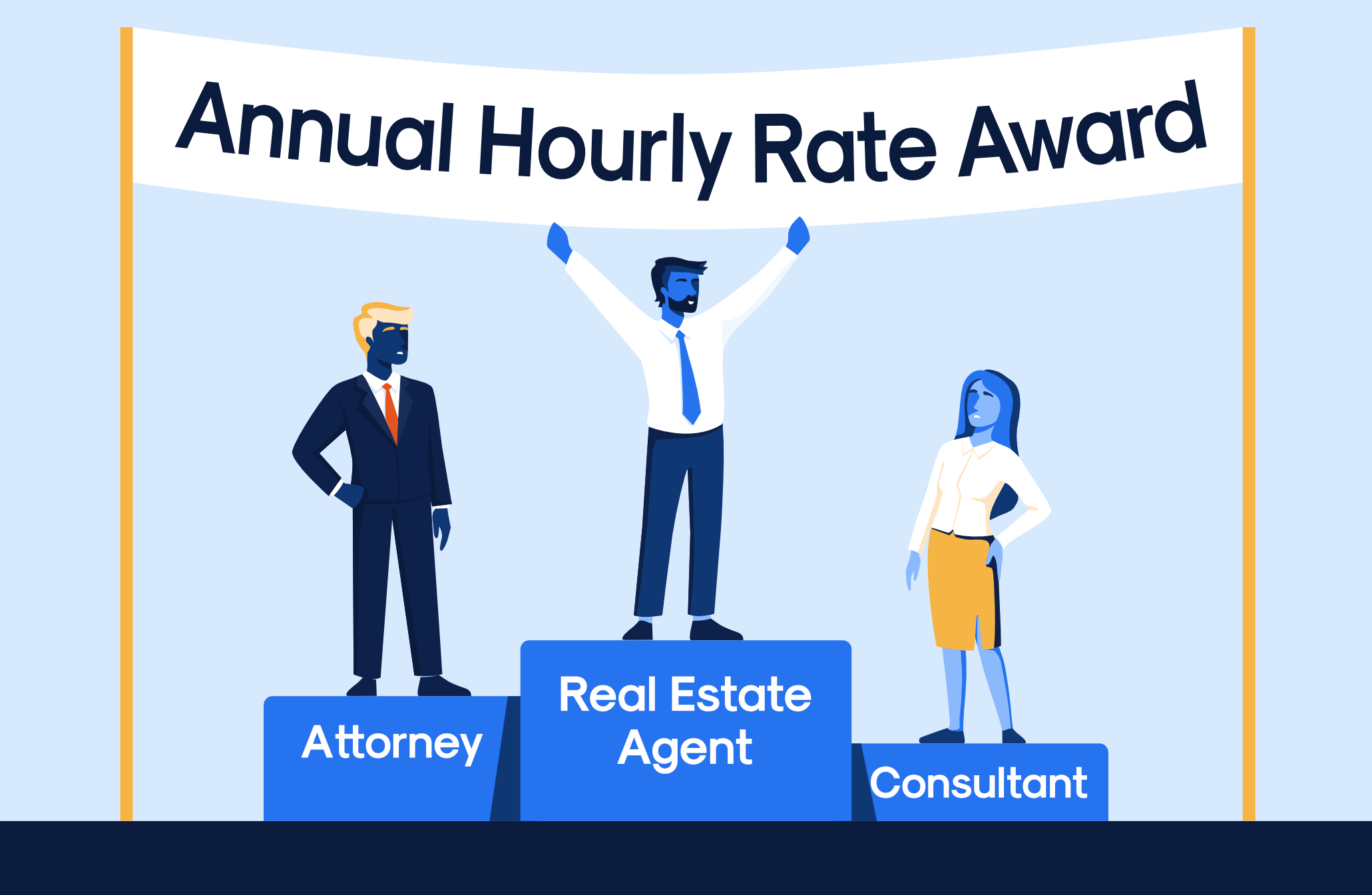

Greed

If your boss asked you to do two to three times as much work for the same pay, you wouldn't be happy, even if you had received a 50% raise over the last ten years while doing less work.

That’s exactly what you’re doing by asking a “traditional” real estate agent for a commission rebate. Even though your transaction would remain extremely profitable, it’s easy for them to get comfortable and convince themselves they deserve $700/hour.

It takes a new entrant like Yoreevo to build a business around buyer agent commission rebates — and to have more reasonable expectations!

Transaction Size and Frequency

The best thing traditional agents have going for them is NYC apartment purchases are large and infrequent. It’s hard to be an expert at something you only do every 5–7 years — the average holding period for NYC real estate.

First-time buyers can be risk-averse and mistakenly assume they must pay 3% for their agent. When Yoreevo speaks with repeat buyers, the conversations are much shorter. They know what an agent actually does and recognize a 3% commission is absurd.

Expense Structures

If you were charging more to do less, you’d do your best to keep that quiet. Agents often try to change the subject by spending money on flashy but unnecessary expenses. Fancy offices, all day car services — buyers end up paying for these. This has locked traditional brokerages into high cost structures that require high commissions so they couldn't offer rebates even if they wanted to.

Thankfully, you don't have to use a traditional agent and you are now an expert on commission rebates! If you've made it this far, we're pretty sure you'd agree everyone should get one. Call or email us at info@yoreevo.com and you’ll be on your way to a commission rebate!

Note: This post should not be used as tax advice. Please contact a qualified accountant if you have any questions about your particular situation.