We generally find buyers looking for an investment property fall into two buckets. The first is looking for a condo that they can rent with as little friction as possible. The second is looking for a co-op with a flexible sublet policy and it’s easy to understand the appeal here - co-ops are significantly cheaper than condos so all else equal, returns will be higher.

However, while the headline numbers can be attractive, under the surface there are a lot of problems with subletting co-ops and using them as investment properties.

Sublet Policies - The Fundamental Problem With Co-ops as Investment Properties

The main problem with co-ops as investment properties is you need board approval to rent the apartment. In co-op parlance, this is called “subletting” because owners are technically renting under their proprietary lease.

Every co-op will have its own sublet policy which explains when an apartment is eligible to be sublet. Usually these policies are structured as you can only sublet after you have lived in the apartment for a certain period of time and then only at a certain frequency.

For example, a very common sublet policy is two out of five years after you live in the apartment for two years.

In this example, after you’ve sublet the apartment for two years, you’d have to move back in, leave the apartment vacant for three years or sell it. The first two options aren’t really practical so owners usually sell.

However, there are co-ops with flexible sublet policies where there is no limit on how long you can sublet the apartment and therefore are potential investment properties but they’re not without issues.

Co-op Sublet Policies Can Change

It’s important to remember that sublets are always subject to board approval. Regardless of what the sublet policy is, an application can be turned down.

We often stress this when a sublet policy doesn’t have a cap but implies subletting is discouraged. An example would be escalating fees (more on fees below). In these scenarios, we summarize the policy to our buyers as “unlimited but don’t push it.”

The co-op board can also change the building’s sublet policy. This would be expected if sublets are causing problems in the building. For example there could be a few problematic subletters or simply too many of them.

Most banks won’t lend in a building that is predominantly rented so if a building approaches that 50% threshold, the board could restrict subletting in order to preserve access to financing. If it’s difficult to get financing in a building, values will decrease significantly since units can only be sold to cash buyers.

In short, unlike a condo where you have a virtually unrestricted ability to rent, even flexible co-ops can always restrict your ability to sublet.

Co-op Sublet Applications Are Cumbersome and Take A Long Time

One of the most overlooked problems with subletting co-ops is simply that the process itself is a pain.

A sublet application is very similar to a purchase application which to put it mildly, requires some effort. Not only does a prospective renter need to compile their life into a PDF for the board’s review, they also need to be interviewed. The process requires a lot of work and a long time.

When compared to a rental building where a renter can sign a lease on the spot with a pay stub and credit check, co-ops aren’t nearly as attractive and renters need to be compensated in the form of lower rent in order to go through the process.

The lengthy approval process often leaves co-ops vacant which can quickly become a huge cost.

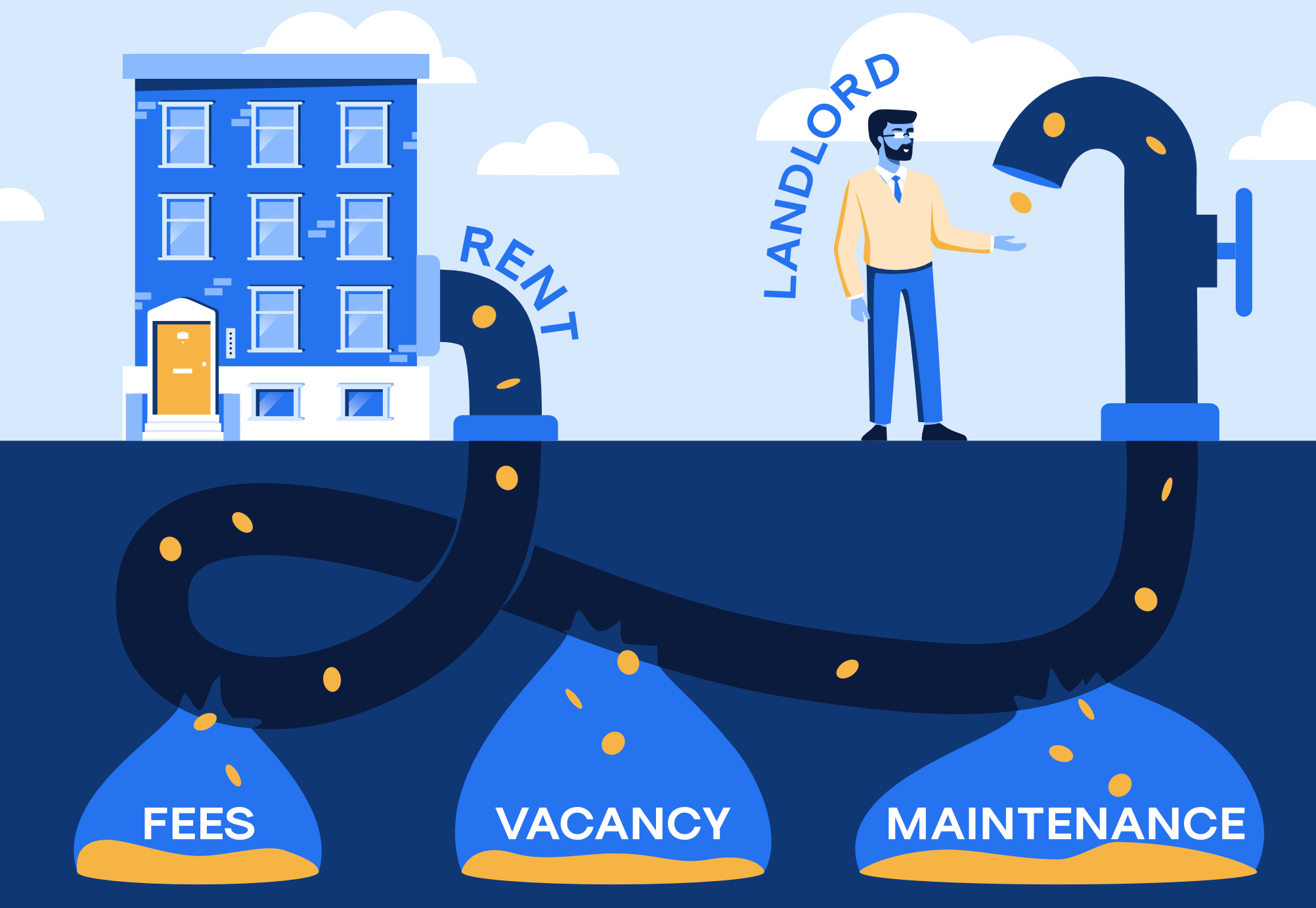

Significant Sublet Fees Charged by the Co-op

Co-ops don’t allow subletting out of the goodness of their heart. They’re also in it for the cash!

Virtually all co-ops, even those with flexible sublet policies, charge shareholders for the right to sublet their apartment.

These fees are most commonly calculated as a percentage of maintenance, typically 20-30%, for the duration of a sublet. The fee can also be structured as a percentage of rent or a fixed amount per share. These fees take a big bite out of the investment’s gross capitalization rate (“cap rate”) and leave the net cap rate less attractive. Fees can also increase over time to discourage extended subletting.

In addition to sublet fees, most landlords pay a real estate agent one month's rent and management gets their cut by charging fees such as an application fee, credit check fee and move-in fee. There is also ongoing maintenance costs such as replacing broken appliances and repainting. It’s worth noting these fees apply to condos as well.

Subletting Doesn’t Always Go Smoothly

In addition to all the time it takes to actually sublet the apartment, being a landlord is not a hands off job. This is especially the case if renters become difficult.

It’s easy to imagine an ideal scenario - the rent check shows up on the 1st of the month and you otherwise never hear from your renters - but that’s not realistic. Things can break, rent might not get paid, neighbors can complain. As the landlord, you’ll need to deal with all of this.

So When Does Subletting a Co-op Make Sense?

There is definitely value in having the ability to sublet should you need it.

For example, if you suddenly get transferred to LA and don’t have the time to sell your apartment, subletting can be a great option. While the subletting process is cumbersome, it’s less cumbersome than selling and the rental market moves much faster than the sales market.

Subletting can also give you the flexibility to ride out a weak market. For example, many would-be sellers decided to sublet rather than sell during the depths of COVID. Of course if you need the equity in your current home to buy the new one, this doesn’t apply.

But don’t make the mistake of overvaluing this flexibility. Yoreevo strongly suggests crunching the numbers and seeing how much you can realistically make after all of the costs described above. You’ll often find these returns to be nominal relative to the purchase price of the apartment. Said differently, the cap rate of co-ops is often very low so in actuality, subletting is often speculating on the overall NYC real estate market, assuming you’ll be able to sell for more in the future.

Subletting and/or Selling Your Co-op with Yoreevo

If you're looking to sublet your co-op, Yoreevo can handle the entire process! We'll make the listing look amazing with professional photos, a video tour, virtual tour and fresh floor plan. After completing the rental, we can also manage the property for you.

Considering selling? We do that too and we'll reduce your closing costs by up to 4%!

For more information, you can click here, email info@yoreevo.com or call 212-365-0151. We’re happy to run you through either process. We can also list your apartment for both sale and rent at the same time if you’d like to explore both options.

And if you're looking to buy a co-op and want to get in the weeds on co-ops and their sublet policies, we have worked with tons of buyers all across the city and know most policies off hand. In addition, all of our buyers receive NYC’s largest commission rebate at closing, averaging more than $24,000!