There’s a lot that goes into the home buying process in any market and NYC can be especially complex. For first time home buyers, just understanding everything can be an uphill battle. It’s often not clear what you need to do and what you should do at each step.

Yoreevo has a couple tips for anyone thinking about becoming a first time home buyer and those actively engaged in the process.

Table of Contents:

Decide If Becoming A First Time Home Buyer Makes Sense

Get Pre-Approved!

Find An Agent Who Has Worked With First Time Home Buyers

Understand The Bidding and Contract Process

Plan For A Realistic Closing Timeline

Above All, Don’t Get Discouraged!

Decide If Becoming A First Time Home Buyer Makes Sense

Before you spend any time on your search, you need to make sure that you should be buying in the first place. This is a step a lot of buyers skip and one we can’t stress enough.

First time buyers will often initiate the process as soon as they can afford it but buying isn’t right for everyone. There are some significant lifestyle boxes you need to check before confirming that buying is right for you.

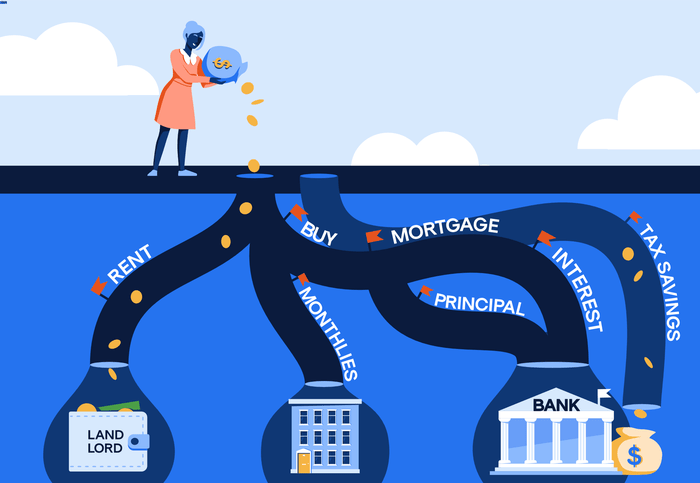

We have a dedicated buy versus rent post which goes into the details. As a quick summary, if you don’t expect to live in the property for at least five years, you shouldn’t buy. Why five years? Because transaction costs are high and that’s a reasonable expectation for how long it will take to break even.

If there’s a good chance you’ll need a larger home or want to move in the next five years, you’re probably better off renting. Buying with an unstable job is also risky, even if you can afford it.

Get Pre-Approved!

Once you’ve confirmed buying is the right decision, you need to figure out how much you can afford. There’s no point in looking at homes out of your budget - that’s not a good use of anyone’s time.

During the pre-approval process, a lender will gather your basic financial information and determine how much they will lend to you. The process is relatively quick and often can be accomplished in a day. The paperwork is also minimal at this point. Your lender will ask for all your documents after an accepted offer, during the underwriting process.

A pre-approval is important for two reasons. First, it tells you how much a lender will loan you and allows you to focus your search accordingly. The amount might be higher or lower than you expected. It’s not until a lender takes a look at your financials that you’ll have a good sense for your budget.

A pre-approval is also going to be required when you eventually bid on properties. It gives the seller confidence you have the financial capability to buy the home.

Please note that a pre-approval is not a guarantee you’ll get a loan. The lender is basically saying that if everything you told them is true and nothing changes for the worse, they should give you a loan.

Find An Agent Who Has Worked With First Time Home Buyers

While it’s fine to browse on your own, you’re going to want a buyer’s agent when the search begins in earnest. Hopefully this post is helpful but it’s nothing compared to the step by step guidance a good agent will provide throughout the transaction.

You’re also going to want an agent who works with first time home buyers frequently, an agent that really gets them and can anticipate your questions.

Make sure to interview a few agents before picking one. It's smart to ask about their first time home buyer experience. You'll want to hear how they adjust their services specifically for first time home buyers.

A good agent will explain every step of the process, no matter how trivial it may seem. Tons of communication, in whatever form is most convenient for you, is a must - you want to stay informed at every step!

What will your agent actually do? Check out this post for the details but basically they’ll guide you through the process and look out for your best interests. Your agent is almost always paid by the seller which is nice but even better, Yoreevo shares most of its commission with buyers which will save you up to 2% on any NYC property!

Understand The Bidding and Contract Process

There are a lot of checkpoints in the bidding process. Keeping track of them and the importance of each can get confusing.

When submitting a bid, you’re going to need a few documents. There’s the aforementioned pre-approval as well as a financial statement. A financial statement gives the seller a rough sense of your financial situation and is especially important for co-ops where you need to meet additional financial requirements. If you are purchasing all cash, the seller will want to see a bank statement showing you have enough money.

After you submit your initial bid, there are usually a few rounds of counters and follow-up bids. If you’re able to get to an accepted offer, congrats! That’s a big step!

At this point, your attorney gets to work, conducting due diligence and ironing out the details of the contract. What problems could arise during this process? All sorts of things. Some examples include -

- There is a problem with the building’s financials

- Something negative was not disclosed previously - an upcoming assessment, for example

- An inspection uncovers construction issues (more common for houses)

- You are outbid

That last item is often surprising for first time buyers but nothing is official until the contract is signed. Until that point, either party can walk away from the transaction.

If there are no surprises during due diligence and everyone can agree on the terms of the contract, both parties sign and you put down a 10% deposit. Now it’s official!

Plan For A Realistic Closing Timeline

First time home buyers always ask how long it will take to close and always receive the same squishy answer - “it depends.”

Why is it so hard to estimate the time required to close? Because there are a lot of parties to the transaction and any one of them can alter how quickly the transaction moves. There’s the buyer and seller obviously but you also have the attorneys, lender, management company and board.

If you have a good agent, they will keep the process moving. Documents and other to dos have a tendency to sit on desks so it’s a big help to have someone identify the hold-up.

As a very rough rule, from signing the contract, expect a condo to take two months to close and a co-op to take three.

If you have any make or break deadlines - an expiring lease for example - make sure everyone is aware of it from the start and bake in some cushion. Tight timelines often become extremely nerve-wracking, even if they end up not being a problem.

Above All, Don’t Get Discouraged

The buying process is always full of surprises but as a first time home buyer, it’s easy to get caught off guard and frustrated by them. You might get outbid right before signing the contract or find out the building has big financial problems.

Whatever the surprise, don't worry! There are always more properties coming to market! Patience is a buyer’s best friend. Remember you’re making a decision for at least the next five years and you don’t want to rush it. If you understand the process and have a good real estate agent, you’re already way ahead of most buyers. This post is far from exhaustive so feel free to contact us with any questions or to learn about Yoreevo’s commission rebates!