How Does A Buyside Broker Get Paid?

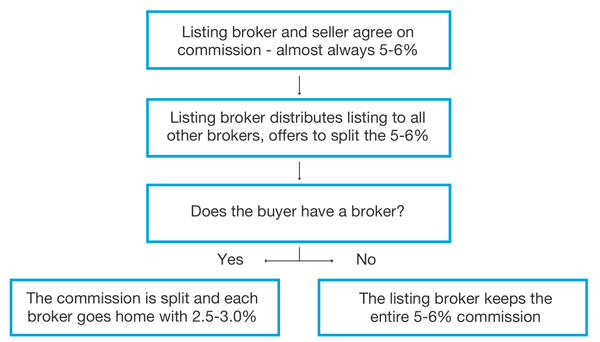

This is a seemingly simple question that many buyers can’t answer even after going through a transaction. Nobody is lying or even misleading you when they say the seller is paying for your broker. It’s 100% true. When the seller signs a listing agreement, they and their broker agree on a commission. The Real Estate Board of New York (REBNY) then requires that commission to be split with any broker that brings a buyer. Critically, the seller does not pay half the commission to the listing broker and another half if there is a buyside broker – it’s the same commission regardless.

Why Are Buyside Brokers Paid By The Seller?

You may be asking yourself:

- Why is the seller paying for the buyer’s broker, someone they’ll never even meet?

- Why is the commission the same even if there is no buyside broker?

- If the seller negotiates the commission, why can’t the buyer?

These are all great questions that again, most buyers do not consider. They hear their broker is “free” or “included in the purchase price” and move on. In Yoreevo’s opinion, that’s exactly why the industry is structured this way. The seller is told they have to pay both commissions because buyers expect it. Meanwhile, the buyer is told the seller will pay so they do expect it. In other words, by having the seller pay it virtually guarantees buyers continue to use extremely expensive broker representation. To revisit the questions above –

- Why is the seller paying for the buyer’s broker, someone they’ll never even meet?

To deviate from the norm introduces an enormous amount of friction for a seller. How would you feel about the one listing that isn’t paying for your broker?

- Why is the commission the same even if there is no buyside broker?

It allows buyside brokers to (correctly) say the commission is being paid regardless so there is no reason not to hire someone.

- If the seller negotiates the commission, why can’t the buyer?

By using Yoreevo and receiving a commission rebate, they effectively can. Continue reading for more.

What If Commissions Were Paid Differently?

Imagine the shock you’d feel if your broker was no longer free and instead, you had to write them a check for $60,000. That is an absurd amount of money and if you think we’re exaggerating, we’re not! $60,000 is simply 3% of the average Manhattan apartment and even if you look at all of NYC – all five boroughs – the average sales price was $1,120,572 in Q2 20171 – so at a 2.5% commission you would be paying your broker $28,000 and at 3.0% it would be $33,000!

To put that in perspective, your attorney is going to cost around $2,500. Your broker is getting paid over 10x more than the person in charge of writing the actual sales contract. By having the seller pay, it doesn’t feel like you’re paying but that does not mean there is no cost to you.

As long as REBNY rules don’t change, you can’t negotiate your buyside broker’s commission. It’s set when the seller signs the listing agreement. However by using Yoreevo, you will receive a rebate for the majority of the commission being paid by the seller. This effectively reduces the commission being paid to the buyside broker.

Our main goal at Yoreevo is to educate buyers and get more people to ask these types of questions. If you think 3% commissions are excessive and it’s time for a change, please contact us and we’ll answer all your questions and get your search started today!