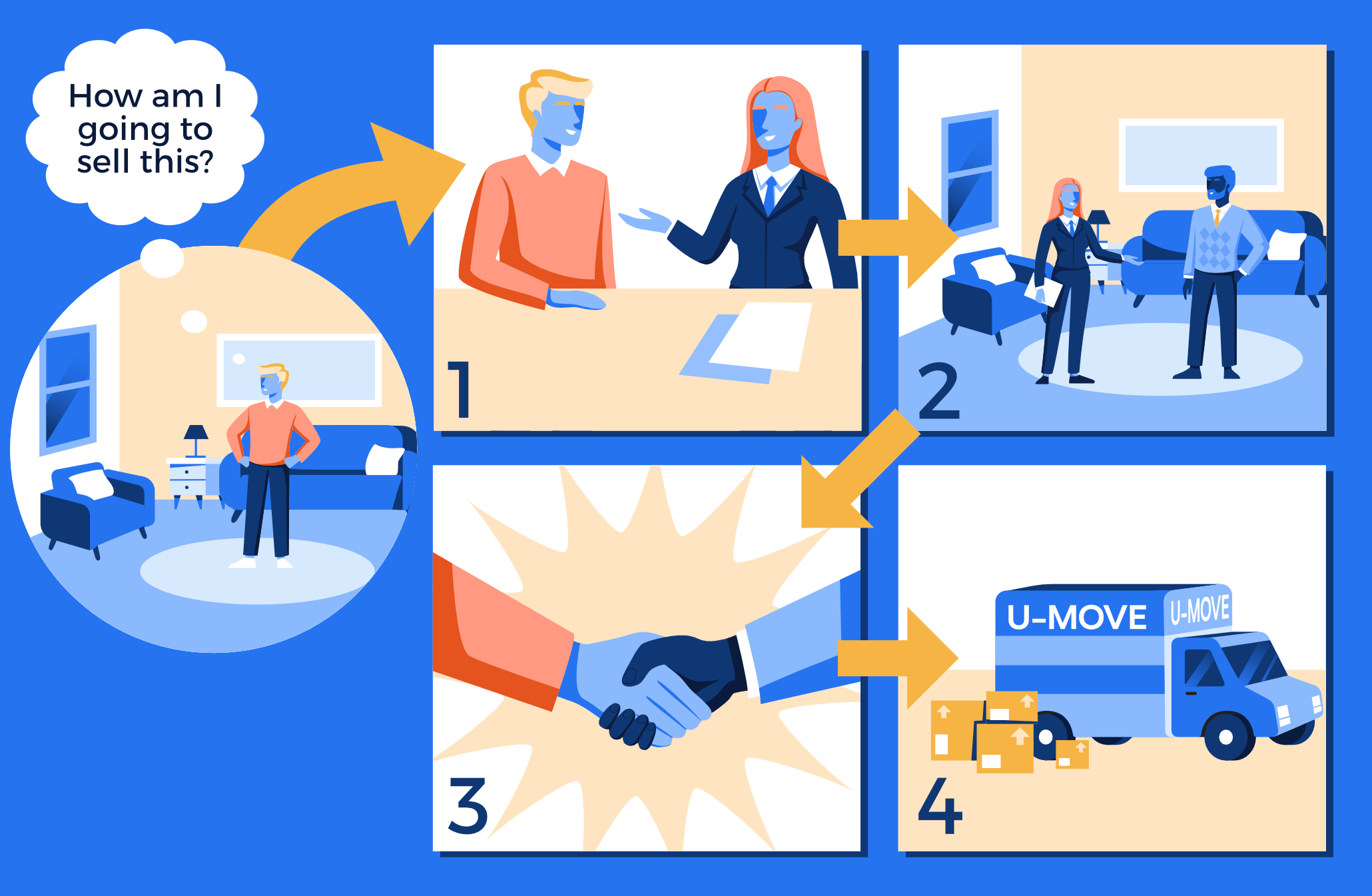

Selling your apartment can be a daunting task. Not only is it a huge transaction, it’s also your home! You want to make sure it’s sold for top dollar in the right way. Yoreevo walks you through how to sell your apartment and what to expect.

Should you sell your NYC apartment?

Should you use a real estate agent or sell FSBO?

How to select a real estate agent

Setting an asking price

How to prepare your apartment for viewings

Marketing your listing

Evaluating offers

What surprises come up while selling in NYC?

How to save when selling in NYC

Should you sell your NYC apartment?

This may seem like a simple question but if you don’t need your capital back, you should give it a second thought. Renting might be a better option.

Selling real estate, even with Yoreevo, is expensive. Closing costs such as broker commissions, transfer taxes and flip taxes can easily hit 7% - 8% of the sales price. These, along others paid when you bought, can wipe out all of the equity you’ve built.

While any investing questions usually get “it depends” as an answer, there is one rule in real estate you can count on. The longer you hold onto a proprety, the more you stand to make. Expenses amortize, prices rise and market cycles are ridden out.

Being a landlord isn’t for everyone and co-op owners likely won’t have the option to begin with but those who are able to rent out their apartment should pause to see if it makes sense for them.

Should you use a real estate agent or sell FSBO?

Most sellers will use a real estate agent. While expensive, they will streamline the process, handle all the work and make sure your listing is marketed properly. If you read our dedicated FSBO post and are still on the fence, you should probably go with an agent.

Before going the FSBO route, you need to make sure your listing will be distributed thoroughly and you will have time to show it.

For distribution, your listing must be online. 99%+ of buyers start their search online so if your listing is not on sites like StreetEasy and Zillow, it might as well not exist. Owners can list directly on these sites but they do charge a fee. Your listing also needs professional photos and a floor plan so it looks as good as all the other listings.

Once your listing is online, you've marketed it. Other forms of ditribution like newspaper ads, buyer lists, etc all became irrelevant with the internet.

Now that your listing is out there, your job is to get buyers to see it in person. The easier you make that, the more people you'll get through the door and the more likely you are to sell. If you can't host open houses every Sunday and make yourself available for mid-week showings, you should use an agent.

If you’re not getting inquiries, you are almost surely priced too high. We address asking prices below.

How to select a real estate agent

When you’re choosing a real estate agent, there are a few things you should look for.

Commissions - Most real estate agents would prefer you skip this step but obviously commissions matter! It's very easy for sellers to assume agents who charge more are better. In reality, agents charge 5% or 6% because everyone else does. If you want proof, check out this chart of global commission rates. More efficient brokerages like Yoreevo are working to bring the US in line with the rest of the world but there's a lot of work to be done!

Trust and Connection - Your agent is selling what is likely your largest asset. You should trust they’ll do their best and since you’re going to spend a lot of time with them, you should like them too!

Transparency - You want an agent who will tell it to you straight. Setting your pricing expectations too high or saying the apartment is perfect (it isn’t) doesn’t do anyone any good. Once the listing is up, your agent should be relaying information about inquiries, showings and feedback. You don’t want sugarcoated data.

Availability - This sounds obvious but it's something sellers often overlook. Buyers need to actually see the apartment before they’ll buy it so you need an agent who is available to show. Part-timers and super busy agents aren’t going to cut it.

Setting an asking price

There are two steps to setting an asking price. First you need to figure out how much the apartment is worth and then can you decide whether a high, low or in-line pricing strategy makes sense.

The value of your apartment is estimated by looking at other sales nearby. These are called “comps,” short for comparables. For example, if the identical apartment upstairs sold for $1,500,000 three months ago, yours is probably worth about $1,500,000 too. Ideally comps should be in your building as that holds as many variables constant as possible.

Once you have a baseline, you can determine what a high or low asking price is. The weaker the market, the less aggressive you’ll want to be. If the market is strong, you could try a high price and see if you get a bite.

Sometimes agents will say they can get a price that’s not supported by the comps. For example, in the scenario above, you should be very skeptical if your agent says they can get $2,000,000. If that happens, just ask why. There should be one or two very clear reasons. If they can’t convince you, they certainly won’t be able to convince a buyer.

When determining the value of your apartment, interviewing more than one agent is helpful. Since each agent will prepare a valuation, you’ll be able to see a range. Theoretically that range should be pretty tight. The comps should point everyone in the same direction but often don’t. Be very skepitcal of any valuation that is light on actual data.

How to prepare your apartment for viewings

While selling an apartment is selling just that, an apartment, it’s also selling a dream. You want buyers to imagine the life they’ll live in your apartment so depersonalizing and decluttering it is key. Take down photos, put away knick-knacks, etc. There is a reason you don’t see wedding photos and baby toys in Architectural Digest.

One tip Yoreevo loves is invite over your blunt friend. We all have one. Have them come in and ask what they’d notice if they were a buyer. Maybe there’s a small crack in the wall or shower grout is a little dingy. Addressing these small imperfections can make a big difference and allow buyers to focus solely on what’s good about your apartment.

Sellers often ask about staging. At Yoreevo, we don’t have any strong feelings. Unfortunately, we don’t have a parallel universe to see if staging does result in higher sales prices. The benefit is fuzzy - we’ve heard buyers say apartments look bigger empty and bigger furnished. Meanwhile the cost is certain. You can easily spend five figures staging an apartment. However it is certainly worth considering and might be a good idea for your apartment.

Marketing your listing

A lot of real estate agents would like you to believe it’s still the 90s when listings were faxed around and having a rolodex of buyers actually helped sell a listing. In NYC, if your listing is on StreetEasy and Zillow, you’ve reached 99%+ of buyers.

Think about how you would shop for apartments. Ads in the newspaper? Waiting for your agent to call with their own listing? Of course not. You’d go online.

Once you leave the dominant listing websites, the benefits of marketing become very fuzzy. Ads in the back of New York Magazine or champagne parties? It’s tough to see how those get in front of serious buyers who wouldn’t otherwise see the listing. These are usually done to appease the seller, not attract buyers.

In all of Manhattan and most of Brooklyn and Queens, going with a REBNY broker will make distribution automatic. Not only will you listing be sent to all the big websites but the co-broke (the commission to the buyer’s agent) will be offered to every REBNY member automatically.

Evaluating offers

Especially when selling a co-op, evaluating the quality of an offer is just as important as the amount of the offer. If the buyer can’t get financing or won’t be approved by the board, it doesn’t matter how much they’re willing to pay.

Every buyer should submit a REBNY financial statement with their offer so you can assess their overall financial picture. It will give you a rough snapshot of their income, assets and liabilities - basically a preview of their lending and purchase applications.

Co-op sellers need to evaluate a buyer’s debt to income ratio and post closing liquidity. Under 25% and 24+ months’ worth, respectively, is enough for most boards. For more information on those metrics, click here.

Condo and house sellers aren’t off scot-free though. If the buyer asks for a financing contingency, the seller retains the risk they aren’t able to get a mortgage.

A lot of these risks are eliminated or significantly reduced with cash buyers. Such buyers offer quick closes and more deal certainty so are almost universally preferred by sellers.

What surprises come up while selling in NYC?

There are a few predictable surprises all sellers should expect.

Delays - There are a lot of steps involved with selling a property in NYC and things don’t move as quickly as everyone would like. While the contract will have a closing date pencilled in, it is not enforceable and you shouldn’t count on it. A safe estimate for closing is three months after signing the contract but you should bake in cushion or have a backup plan.

Inspections - Given NYC is dominated by co-ops and condos, inspections aren’t that common but they do happen. Even if your apartment is in mint condition, you should expect the buyer to ask for a few thousand dollars of fixes. Inspectors are paid to find problems so that’s exactly what they do. If your place really is actually immaculate, that’s great but not what you should expect.

Walkthrough - Often the last potential surprise is right before closing at the walkthrough. If everything has been communicated clearly, this should go smoothly but sometimes sellers aren’t clear about what they’re taking (light fixtures for example). The apartment should be “broom clean,” empty and the appliances in working condition. By checking yourself prior to the walkthrough, this should be a non-event.

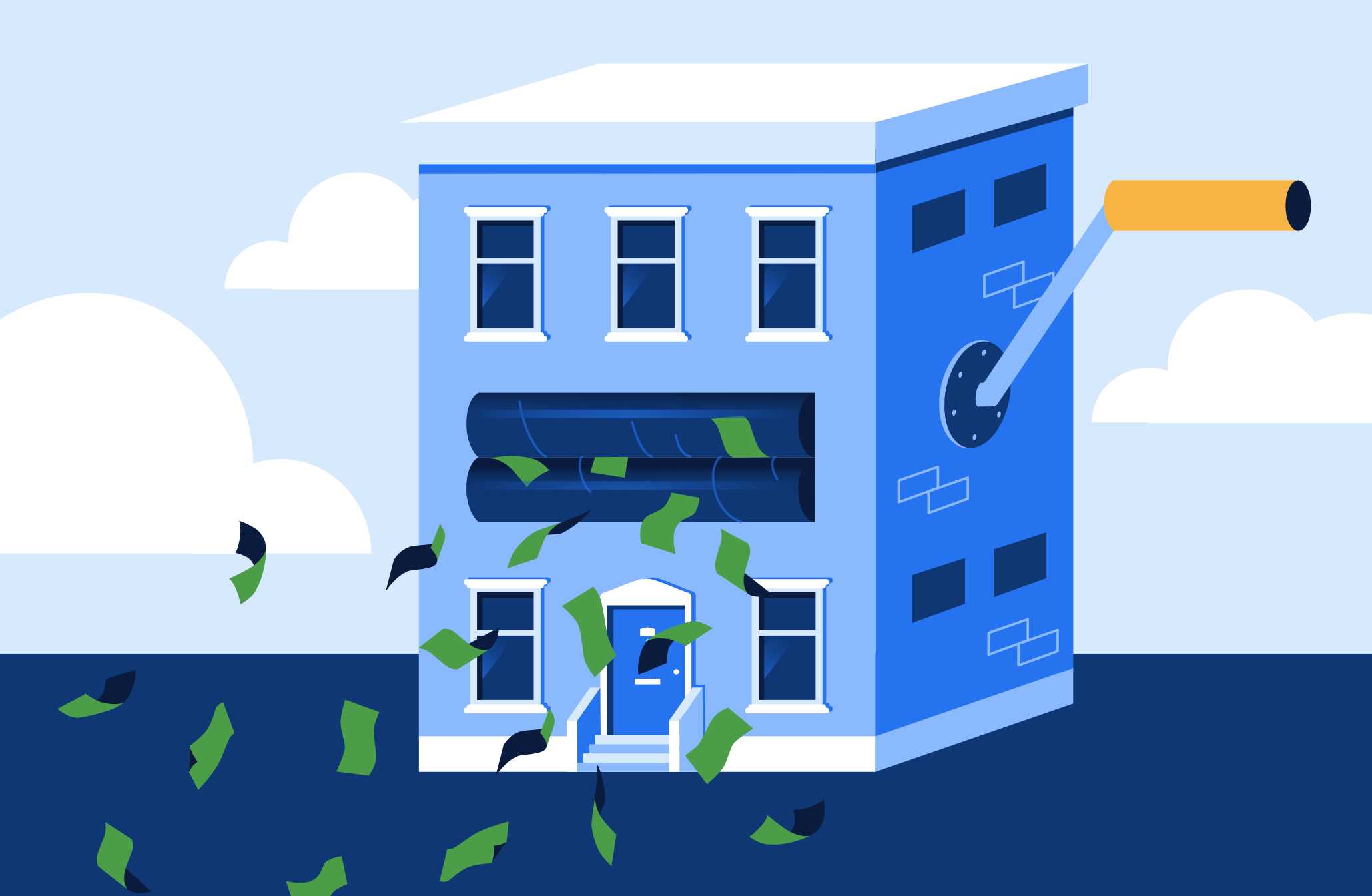

How to save when selling in NYC

You bought an apartment with the hope of making some money so let's make that as easy as possible and reduce your largest closing cost - the brokers! Brokerage commissions will be your largest closing cost as a seller, larger than anything you paid when you bought.

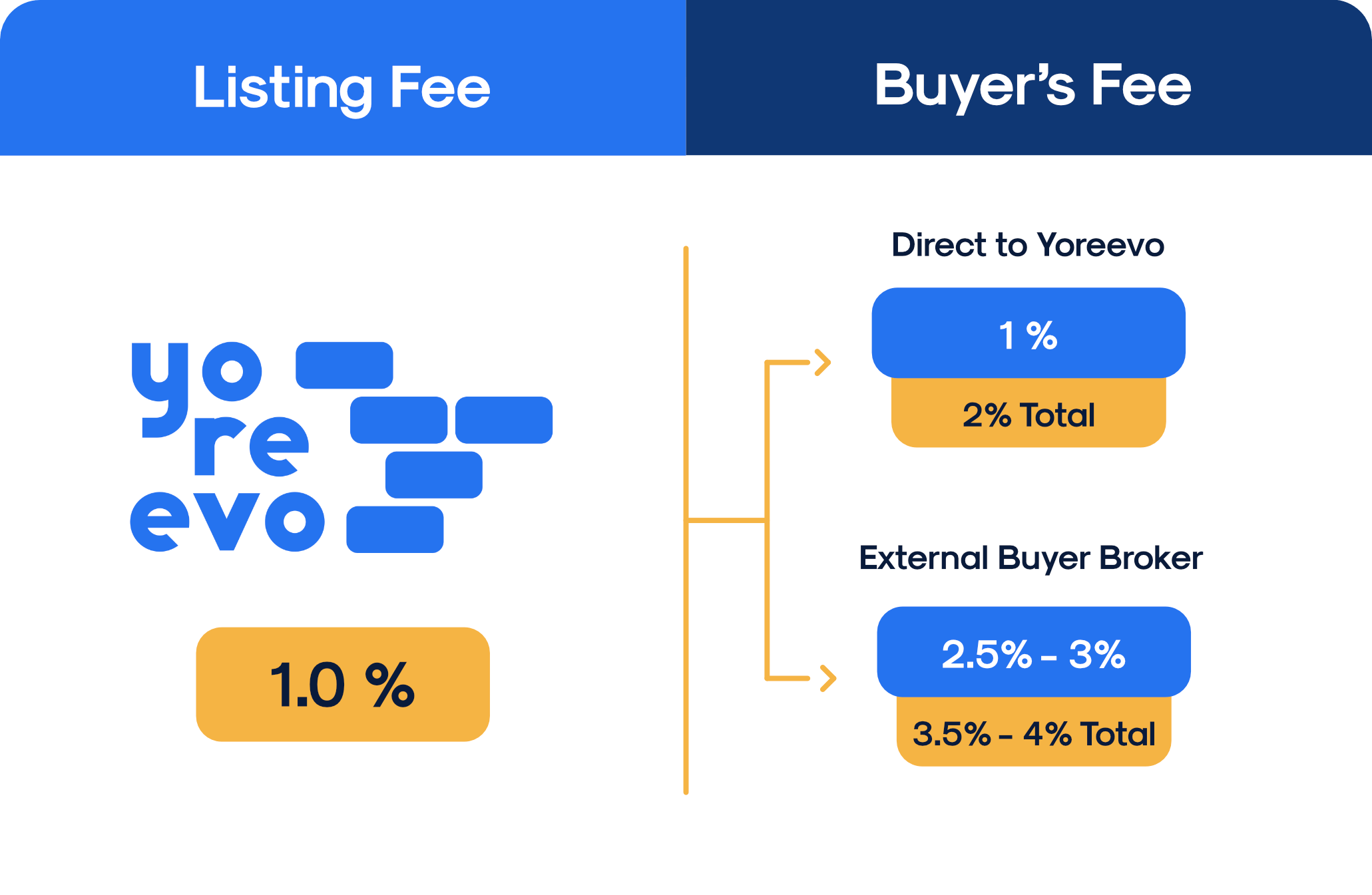

With Yoreevo, your sell side commission will be 1% if you also buy with us (1.5% if you only sell) and your total commission will be 2-4% versus 5-6% with a traditional broker. How do we do it? By contacting us, you've already saved us a ton of money and we pass those savings on to you!

As a REBNY and OneKey member, your listing will be distributed everywhere, ensuring it will get in front of as many buyers as possible. For all of the details, contact us or give us a call and we'll walk you through it!

Note: 1% listing fee assumes that you also buy with Yoreevo within 365 days before or after your sale. If you only sell, the listing fee is 1.5%. Minimum commissions apply.