Just because NYC real estate is expensive, doesn’t mean the process needs to be complicated. With a little homework, you’ll be very well prepared to navigate the process.

Consider this buyer’s guide your homework! By combining the general knowledge below with a buyer’s agent for the specifics of your transaction, you’ll be in great shape for a smooth transaction!

Should You Buy?

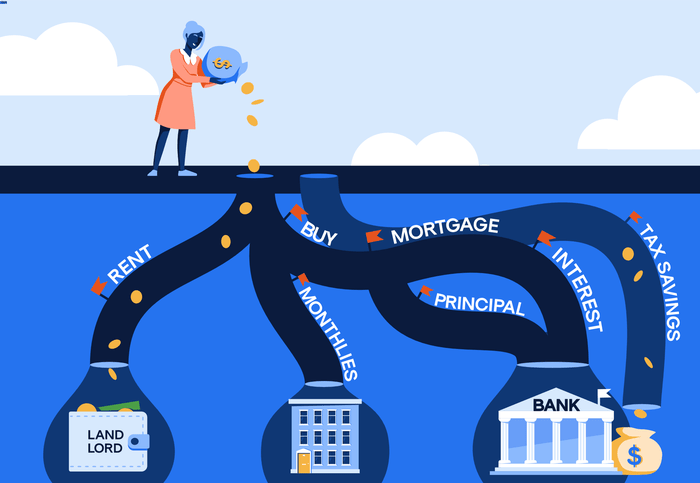

This buyer's guide is a bit long so before you go through everything, let's make sure you should be buying in the first place. Just because you can buy doesn’t mean you should buy.

Transaction costs involved in buying and eventually selling an NYC property are high - usually around 10% of the property’s value. If the property doesn’t go up 10% in value, you’ll lose money on it. The sooner you sell, the less time the property will have to appreciate and more likely you are to lose money.

Yoreevo recommends you plan on staying in a property for at least five years if you are going to buy. If that’s not likely, renting might make more sense.

What would cause you to sell before five years? Consider a few possibilities -

- Is your family likely to grow? You may need a larger space.

- Is your job stable? If you are relocated or lose your job, you may have to sell.

- Do you love the neighborhood? You can’t move your property if you get sick of the location.

If you would like to take a deeper dive, make sure to check out our buy versus rent post.

What To Know Before You Start Looking

You’ve looked into your crystal ball. You’re pretty sure you’ll stay put for the next five years. Buying makes sense and you’re ready to get started. Great!

Before you plan this Sunday’s open house schedule, there are a few things you should know about the search itself.

Timing - If you have a hard deadline by which you need to be closed (an expiring lease for example), start looking six months ahead of time.

Why so long? Six months gives you about three months to find a place and another three months to close. Surprise delays are more common than everyone would like so it’s good to have cushion.

Understand Your Budget - While you probably have an idea about your budget, it’s not until you talk to a lender that you’ll really know. The amount may be higher or lower than you think.

After reviewing a quick snapshot of your financial situation, a lender will tell you approximately how much you can borrow and give you a pre-approval letter saying as much.

A pre-approval is a preliminary thumbs up from the lender. It does not guarantee the lender will actually make the loan. It’s more like they are saying if everything you said is true and nothing changes for the worse, you should get the loan.

Closing Costs - While you are looking at total transaction costs of about 10% to buy and sell a property, most of those are paid when you sell. As a buyer, your total bill will depend greatly on what kind of property you buy.

Transaction costs can be anything from a few thousand dollars to over 5% of the purchase price. The high end of that range is for new construction so by focusing on resale, you can be relatively sure you won’t pay more than 3%. We have a buyer closing costs post that goes into greater details.

Find A Buyer’s Agent

This buyer’s guide will give you a general sense for the process but it’s nothing compared to the assistance you’ll get from a buyer’s agent. While you are not required to use a buyer’s agent, to go without one, especially first time buyers, is extremely risky.

Very broadly, a buyer's agent helps you through the steps of a transaction and looks out for your best interests. A more detailed description of services provided is available here. Conversely, the listing agent is required to look out for the seller’s best interests.

Going direct to the listing agent is like going to court and asking the other side’s attorney for advice. You’d never do that! If you do, you’re opting in to “dual agency” which is just like it sounds - one agent represents both sides. There are numerous potential issues with dual agency, so many in fact that it’s illegal in some states. For more information, we have a dedicated post about using a buyer's agent versus going direct.

Quick summary - use a buyer’s agent!

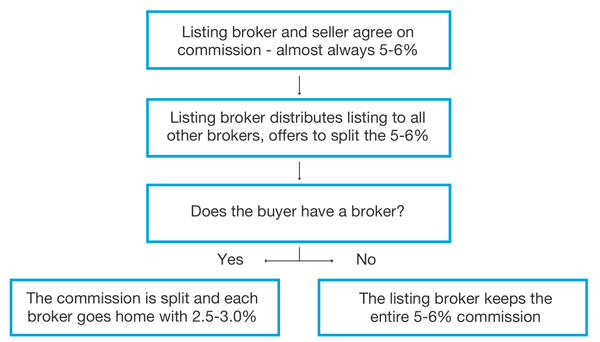

But what about the cost of a buyer’s agent? You’ve likely heard a buyer’s agent is free. That’s both true and untrue. Your agent is free in that you won’t pay them directly but someone is. Your agent is paid by the seller’s agent - most commonly 3% of the transaction value.

What sounded like such a benevolent role (“free!”) looks a little different after you actually compute 3% in dollars. You're paying the commission, it's just baked into the purchase price.

Yoreevo adds a step to the process with our commission rebates. After we get the commission for representing you, we write you a check for most of it!

Be very skeptical of any paperwork at this stage. The only form you should see is the New York State Agency Disclosure Form. As indicated in big bold letters at the top, it is not a contract and just for your information. It is extremely rare for a buyer’s agent to ask for an exclusive representation agreement in NYC.

A Buyer’s Guide To Financing

You don’t need to understand the nuances of financing at this stage but you should be familiar with the basics. Below are some of the most common questions we receive about financing.

What is a pre-approval letter? A pre-approval letter (or just “pre-approval”) is issued by a lender after a preliminary review of your finances. The letter will say what what type of loan you should be able to get. It is not a guarantee you will get a loan.

Why do you need a pre-approval letter? Sellers require a pre-approval because it shows a lender has taken a look at your finances and likely to issue you a loan. Without a pre-approval, there’s a risk you can’t actually purchase the property. For example, if you went into a $50 million listing and said “I’ll take it!” the seller would want proof you could, in fact, take it. A pre-approval addresses that concern (on a real world scale!).

Should I go to mortgage broker or bank? First, let’s define what a mortgage broker is. You may have figured it out from the name. For lack of a better term, a mortgage broker is a middleman between you and your lender.

The benefit of a mortgage broker is they have relationships with a number of lenders and can help determine which is best for you. They’ll also save you time since you only need to apply once and can see what various banks can offer. If you have a quirky situation, they may also know a lender that will work with you.

A bank may make sense if you have a history with them. Often banks will give long-term clients discounted rates, waived fees or other benefits. It’ll also be easier to work directly with the lender if any minor issues come up.

What financial requirements should I meet? This will depend on the type of property you buy. The table below outlines some rough NYC guidelines.

| Co-op | Condo | House | |

| Min Down Payment | 20% | Usually 10% | Dictated by Lender |

| Max Debt To Income Ratio | Ideally 25% (Varies) | Dictated by Lender | Dictated by Lender |

After you lock in your rate, it is good for a certain number of days which varies from lender to lender. Your lender will usually charge to extend a rate lock so you don’t want to lock in until you’re pretty sure of the closing date.When should you focus on interest rates? Since interest rates factor into affordability, your approximate interest rate should be considered at the start. When you get your pre-approval, your lender will be able estimate your interest rate. However you won’t “lock in” your interest rate until later in the process.

Do you have to use the lender that issued your pre-approval? Nope, you are free to use whomever you want. The only exception is for new construction where the developer may require a specific lender if requesting a financing contingency.

Narrowing Your Search

At last count, there were over 3.4 million properties in NYC so you need to narrow down the field! The more targeted you search, the easier and faster it will be.

What questions will help focus your NYC property search?

- Which neighborhood is my top choice? Second choice?

- Which subway line(s) should be nearby?

- Does a condo or co-op make more sense?

- How many bedrooms do I need? What about square footage?

- Do I need in-unit amenities? A washer/dryer, for example?

- Are a doorman and elevator requirements?

- Does the building need to be pet friendly?

- Do I need the building to have certain amenities? Gym? Roof deck?

You and your agent should discuss each of these questions in detail. If you have a clear preference for everything above, you should be left with a manageable amount of properties.

Viewing Properties

You targeted your search, you have a manageable list, now it’s time to go out and actually see properties!

Browsing online is great but it’s no substitute for seeing properties in person. You’ll be very surprised how quickly you get a handle on not only what you like but also how much you think each home is worth.

The two options for viewings are open houses and private showings. Open houses are pretty straightforward - stop by during the designated period and check it out. Alternatively, if you want to see the property at another time, your agent will arrange a private showing with the listing agent.

By seeing a number of listings, you’ll be able to compare them more easily, especially if you are shopping in a tight price range. While it’s possible to overdo it, err on the side of seeing too many homes. That way, when you finally find “the one,” you’ll know it.

Submit Offer(s) Once You’ve Found The One(s)

You finally found the perfect property but what goes into submitting an offer?

Your agent conducts a “valuation” of the property by looking at recent transactions in the area. For apartments, you’ll focus on transactions in that same building. For houses, other recently sold houses in the area will be analyzed. Adjustments will be made for condition, size, layout, floor, view, etc. The conclusion may be that the property is undervalued, appropriately valued or overvalued.

As far as paperwork goes, you’re going to need your pre-approval and a REBNY financial statement. This is a form that gives the seller and listing agent a high level snapshot of your finances.

If you know which attorney you will using (more on this later), we encourage buyers to include their contact information but it is not necessary.

After you submit an offer, the seller will likely “counter” with something between your offer and the asking price. You will then have the opportunity to submit a new offer and the process repeats. If this sounds confusing, don’t worry! Your agent will guide you through each step.

We are often asked if it’s okay to submit offers on multiple properties at once. Absolutely! There is nothing binding about an offer, even after it is accepted. Just like the seller can entertain multiple offers, you can submit multiple offers.

Eventually, if you and the seller agree on a price, congrats! You have an accepted offer! That’s a significant step in the purchasing process.

Your Offer Was Accepted!

While an accepted offer is a big step, nothing is legally binding until a contract is signed. At this point, your attorney takes over and gets to work on the contract and “due diligence.” Both of these are critical to protecting you during the transaction. If you'd like a more detailed look at this stage click here.

Due Diligence

During due diligence, your attorney will look at the building’s financials, offering plan, bylaws, and other documents. If you are buying a house, you’ll also hire a home inspector to make sure there aren’t any lurking issues.

The goal of due diligence is to discover any issues before you sign the contract. This is a transparent process and your attorney will review the findings with you.

What are some problems that could come up during due diligence?

- There is a problem with the building’s financials

- An inspection uncovers construction issues (more common for houses)

- You are outbid

Remember, nothing is legally binding until the contract is signed. Before then, either party can walk away without penalty. If someone outbids you during due diligence, the seller is likely going go with them.

Contract

The contract makes everything official and outlines the details of the transaction.

Most importantly, the contract will list the reasons you would no longer be required to purchase the property, protecting your deposit. These are called “contingencies.”

The most commonly requested contingency is a financing contingency which protects you in case you can’t get a loan. This needs to be included as part of your offer. If buying in a co-op, you will also be able to terminate the transaction if rejected by the board.

You’ll have the opportunity to ask questions about the contract throughout the process. Once the attorneys have agreed upon a final version, you’ll be asked to sign and put down a 10% deposit. Then, once the seller countersigns and returns the contract, the deal is official. You are obligated to buy (subject to any contingencies) and the seller is obligated to sell.

All in, it usually takes one to two weeks to go from an accepted offer to signed contract.

The Contract Has Been Signed - Congrats! Now What?

A lot! There are a number of steps that need to be completed after the contract has been signed.

Your contract will lay out the (targeted) timeline for your transaction but most commonly, you will be required to

- Submit your mortgage application within 3 days

- Get a commitment letter from your lender within 30 days

- Submit your board application within 3 days of getting the commitment letter

Remember the timeline in this buyer's guide is just an estimate. If you are at this step, it is extremely important you confirm all deadlines with your attorney.

The contract will also have an “on or about” closing date. This is a date everyone is working towards but not enforceable. For example, if the co-op board hasn’t approved your application by then, there isn’t much you can do. If the date passes though, an enforceable timeline can then be set.

What can you do if you want to get out of the contract? Not much. The contract requires both parties to make a good faith effort to close the transaction.

The Loan Application

While you have your pre-approval, you still need to go through “underwriting.” During underwriting, your lender will basically verify your entire financial situation.

They’ll also order an “appraisal” of the property. This is when an appraiser comes to the property to compare it to recent transactions in the area. Basically, an appraiser tells the bank how much they think the property is worth to make sure it aligns with the purchase price.

Once the documents have been gathered and the appraisal completed, the bank will issue a “commitment letter.” This is a letter from the bank saying that, subject to any outstanding conditions, they will make the loan. A commitment letter is the goal and deliverable of the underwriting process.

If you are purchasing a co-op, your lender will also give you a few “Aztech Recognition Agreements.” This sets some rules between you, your lender and the co-op. They will be required for your board package and importantly, the forms need to be originals - no scans or printouts.

The Purchase Application and Co-op Interview

Both co-ops and condos will require a purchase application and it can be started as early as the accepted offer. The documents required vary building to building but generally, co-ops will require a few more. Common requirements for both are:

- Completed purchase application

- Fully executed contract

- Commitment letter (if financing)

- Tax returns

- Credit and background check

- Letters of recommendation

- And likely many more

All components are required and incomplete applications will be returned. While the list may seem daunting, your agent will help throughout.

For a co-op, the goal at this step is to get an interview. An interview is a significant step towards getting approved. If a board didn’t plan on approving you, they wouldn’t schedule an interview.

Most of the time, the co-op interview is an opportunity to meet people in the building and not a full blown interview. That being said, you should review your application beforehand in case the board does have questions.

A condo can’t actually reject a transaction, it can only exercise its “right of first refusal.” In that case, the condo would have to buy the unit from the seller on the same terms. As you can imagine, that doesn’t happen often.

As far as timing goes, this step is a black box. You can’t contact the board and even if you could, rushing their decision wouldn’t be a great idea. Condos generally move quicker but that’s far from a rule. From submitting the application, 2-4 weeks to get approval is typical. In a co-op, you’ll then need another few weeks to get the interview scheduled and completed.

This section of the buyer's guide is meant to be high level. For a lot more detail, please check out our post comparing co-ops versus condos and another that focuses on co-ops.

Closing - The Last Step!

Once your attorney has received board approval (co-op) or a waiver of right of first refusal (condo), it’s almost official! That’s the last significant step before closing and you’re mostly dealing with scheduling. The attorneys will schedule a day that works for them, you, the seller, bank and management company.

After a closing day has been set, your agent will schedule the walkthrough. It’s probably been a month or two since you saw the property so this is your chance to make sure nothing has happened since then. You’ll also make sure all the appliances are in working order, outlets work, toilet flushes, etc.

You’ll want to do the walkthrough either the night prior or immediately before the closing. The less time until closing, the less opportunity there is for something to break.

Ahead of closing, your attorney will prepare a list of checks to bring to the closing. You’ll also be instructed to bring your photo ID. Then you just need to show up, sign a lot of documents and pat yourself on the back - you did it! You’re a homeowner!

About Yoreevo - The New Way To Buy

Yoreevo is changing the way New Yorkers buy and sell real estate. Ever wonder why commissions in NYC are 5-6%, just like they have been for decades? We did.

Our business model is different than other brokers you may be considering. All of our buyers receive NYC’s largest commission rebate, more than $24,000 on average.

Commission rebates are growing rapidly in popularity as more buyers realize there is a better way. After just two years, Yoreevo has helped clients buy and sell over $80 million of real estate and save well over $1,000,000!

We, the founders and first agents of Yoreevo, strive to provide the best possible service. By combining a fantastic experience and commission rebates, we believe Yoreevo is the future of the real estate brokerage.

Whether you're just thinking about buying or ready to submit an offer, make sure to contact or call us to join the growing community of New Yorkers benefiting from commission rebates today!.