Has a broker, lender or talking head on TV told you to buy now because interest rates are going up? If so, you need to tell them they’re in the wrong business – they could make billions of dollars with that information!

To very quickly summarize this blog post - nobody knows where interest rates are going and you should ignore all forecasts!!

Table of Contents:

Which Interest Rates Are Going Up Anyway?

Why Doesn't A Rising Fed Funds Rate Matter To Buyers?

Why Doesn’t The Fed Funds Rate Impact Mortgage Rates?

So What Does Cause Mortgage Rates To Change?

How Should Interest Rates Affect Your Home Buying Process?

Which Interest Rates Are Going Up Anyway?

When you hear about interest rates on the news, it’s almost always referring to the “fed funds rate.” That's the interest rate banks receive on money held at the Federal Reserve (“the Fed”). You can think of it as the interest rate banks get on their savings account.

The fed funds rate is the Fed’s primary tool for implementing monetary policy. By raising interest rates, the Fed makes it more attractive for banks to save their money, leaving less available to make loans. Fewer loans means less spending and the overall economy slows.

In other words, when the Fed raises interest rates, they slow down the economy. When they lower interest rates, they speed it up.

Housing is the perfect real world example - if you were offered a mortgage with a 0% interest rate, you would be more likely to buy. In the process, you'd hire a buyer's agent, get a mortgage, pay movers, buy furniture, etc, all of which stimulate the economy.

So if the Fed is raising interest rates, isn’t that bad for buyers? Won’t mortgage rates go up? Not exactly.

Why Doesn't A Rising Fed Funds Rate Matter To Buyers?

Remember the Fed is raising the “fed funds rate.” Did we say anything about mortgage rates? Nope.

This is where most people go wrong.

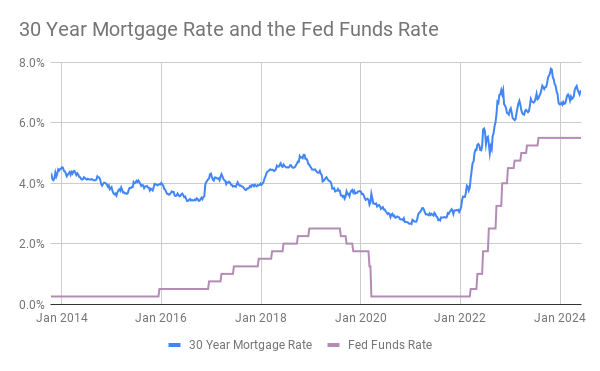

Mortgage rates track the 10 Year US Treasury, not the fed funds rate. The 10 Year US Treasury is the interest rate the US government pays to borrow money for ten years. Look at this chart of mortgage rates in blue and the 10 Year Treasury in purple since 2014 -

Pretty similar, right?

Now what about the fed funds rate? How does that compare to mortgage rates? Here’s the same chart but with the fed funds rate in purple -

There's a correlation but it's actually the 10 Year leading the fed funds rate. You can see this best at the very beginning of 2022. The yield on 10 Year Treasuries took off like a rocket but the Fed didn't do anything until March and even then, only increased the fed funds rate by 0.25%.

Below is a chart that shows the difference or "spread" between mortgage rates and both the 10 Year US Treasury and fed funds rate.

You'll see with the exception of 2020 and the last year or two, the difference between the 30 year fixed rate mortgage and Treasuries was pretty steady at ~1.75%. If you knew Treasury rates, you could add 1.75% and be pretty sure that's where mortgage rates were.

Meanwhile, the fed funds rate spread is all over the place, bouncing between 1% and 4%. There's virtually no correlation and if you knew the fed funds rate, you'd still have no clue what mortgage rates were.

If this is already getting too in the weeds, your main takeaway should be that the interest rate you hear on the news has virtually no impact on mortgage rates.

For those who are interested, Treasury spreads blew out in 2020 because COVID created an incredible amount of uncertainty at the same time demand for mortgages skyrocketed. More recently, we've seen a significant pullback from regional banks due to their mini-crisis, reducing the supply of mortgages and pushing up spreads.

Why Doesn’t The Fed Funds Rate Impact Mortgage Rates?

When you take out a mortgage, you’re borrowing money today, a year from now, two years from now and all the way out to 30 years from now.

At the same time, your bank is lending you money for 30 years and needs to consider what else it could do with that money over those 30 years so they consider today's interest rates and those in the future. If rates are going up, they're not going to lend money for 30 years at today's rate. They would lend at the average rate over that period.

As an analogy, consider this proposal. You're offered -

- $100 this year

- $200 next year

- ...

- $1,000 in ten years

If instead, I offered you $1,000 today, would you take it? Of course not. You’d be giving up $5,500.

A 10 Year Treasury does the same thing with interest rates. It takes everyone’s expectations for interest rates today, next year, up to ten years from now and figures out what that is worth today.

A rising fed funds rate only matters to mortgage rates if it's a surprise. Think about it:

- Everyone agrees - the Fed is going to raise interest rates (the fed funds rate).

- Since everyone agrees, the increase is already included in everyone’s 10 Year Treasury forecasts.

- Mortgage rates mirror the 10 Year Treasury so the increase is also included in today's mortgage rates.

So What Does Cause Mortgage Rates To Change?

One word - expectations.

When everyone starts to think the Fed won’t raise their interest as quickly or aggressively as they previously expected, interest rates go down.

In the example above, what would happen if instead of your payment going up $100 each year, the payments now only went up $50 each year? Even though the payments are still going up, you would be disappointed and willing to sell that future income stream for less. The same thing happens with interest rates - if they're going up but not as fast as previously expected, today's rates go down.

This is why you'll often see the Fed increase rates and 10 Year Treasury rate (and therefore mortgage rates) decreases. In fact, since the market is never exactly right, interest rates are as likely to go down as up when the Fed increases interest rates.

How Should Interest Rates Affect Your Home Buying Process?

Homebuyers typically think about interest rates twice - when they’re thinking about buying in general and when they can lock in an interest rate.

For all of the reasons above, do not let anyone tell you to buy now because interest rates are going up!

However, locking in a rate can be a good idea as it eliminates interest rate risk. Provided you have enough time to close, a rate lock allows you to know exactly what your mortgage payment will be.

This is a lot of technical information so if it went over your head, don’t worry about it! Email us at info@yoreevo.com and we’re happy to answer any questions you have. Yoreevo’s goal is to make home buying easy and transparent while also saving our clients a lot of money with our commission rebates!