With such an incredible track record, it’s no surprise that a lot of people want to buy investment properties in NYC. Between price appreciation and rental income, they can be a home run. However where there’s speculation, there’s also risk. As with any investment, the more you know, the better off you’ll be so let’s get to it!

Table of Contents:

What is an investment property?

Is NYC real estate a good investment?

When is real estate a bad investment?

Should I invest in a condo or coop?

Can an investment property be depreciated?

Is investment property tax deductible?

What are investment property mortgage rates?

Should you buy an investment property in an LLC?

What is an investment property?

An investment property is simply one that is expected to generate a return. That can be via capital return (price appreciation), rental income or a combination of both.

The source of your return will be heavily dependent upon your holding period. If you plan to “flip” a property - that is sell shortly after purchasing - you won’t have the opportunity to generate rental income. Your profits will be entirely dependent upon your ability to sell it for more than you paid.

If you hold a property for many years, you will likely benefit from both price appreciation and rental income.

Investors often compare the capitalization rate or "cap rate" of various investments. This is the amount of cash flow you will generate renting out the property divided by the purchase price. All else equal, the higher the cap rate, the more attractive the investment.

In order to calculate you cap rate, you’ll need your annual expected cash flow. This is equal to the rent minus all common charges, property taxes, maintenance and anything else associated with the day to day operation of the property. You then divide that cash flow by the purchase price of the property. Please note this does not include any mortgage payment. While that is important, a cap rate is meant to identify an investment's return without considering how it is financed.

While your primary residence may end up being a great investment, it is not considered an investment property.

Is NYC real estate a good investment?

NYC real estate is most likely to be a profitable investment when rented out over a long holding period. With time and rental income on your side, the odds of a successful investment increase significantly.

You'll often hear many tips about which neighborhood or type of property will appreciate the most but those are just opinions. For example, investors have long expected property values to rise in Red Hook, Brooklyn but that hasn't played out. The Bronx has also received a lot of speculation with its subways and proximity to Manhattan.

Take these "no brainers" with a grain of salt. After all, if everyone knew prices in a neighborhood were going to skyrocket, why would anyone sell?

There are significant tax benefits for all property investments, including those in NYC. For example, depreciation (see below) allows you to defer taxes on most, if not all, of your cash earnings. When you sell, a 1031 exchange can help defer those taxes even longer!

When is real estate a bad investment?

Real estate can be a good investment if it is handled the right way. You should plan to hold the property for a long period of time and attempt to maximize the return.

Many investors are actually speculators in disguise. They’ll purchase a property with the intention of selling it within just a few years for a nice profit. We see this all the time in NYC. Buyers, especially those from out of town, will purchase an apartment as an “investment” and not even rent it out. They’ll use it a few times a year when they visit and keep their fingers crossed.

This usually does not end well.

Over the course of buying and selling an investment property, you should expect to pay about 10% in transaction costs. Any holding costs (property taxes, utilities, etc.) would be in addition to this.

Therefore, the property will need to appreciate at least 10% and any negative cash flow while holding the property. Remember that is just to get to breakeven. We haven't even considered what's an acceptable return.

However if you have a long time horizon and maximize your return by renting it out, real estate is a fantastic investment. Gradual appreciation, rising rents and tax savings all work in your favor more and more as time goes on.

Should I invest in a condo or coop?

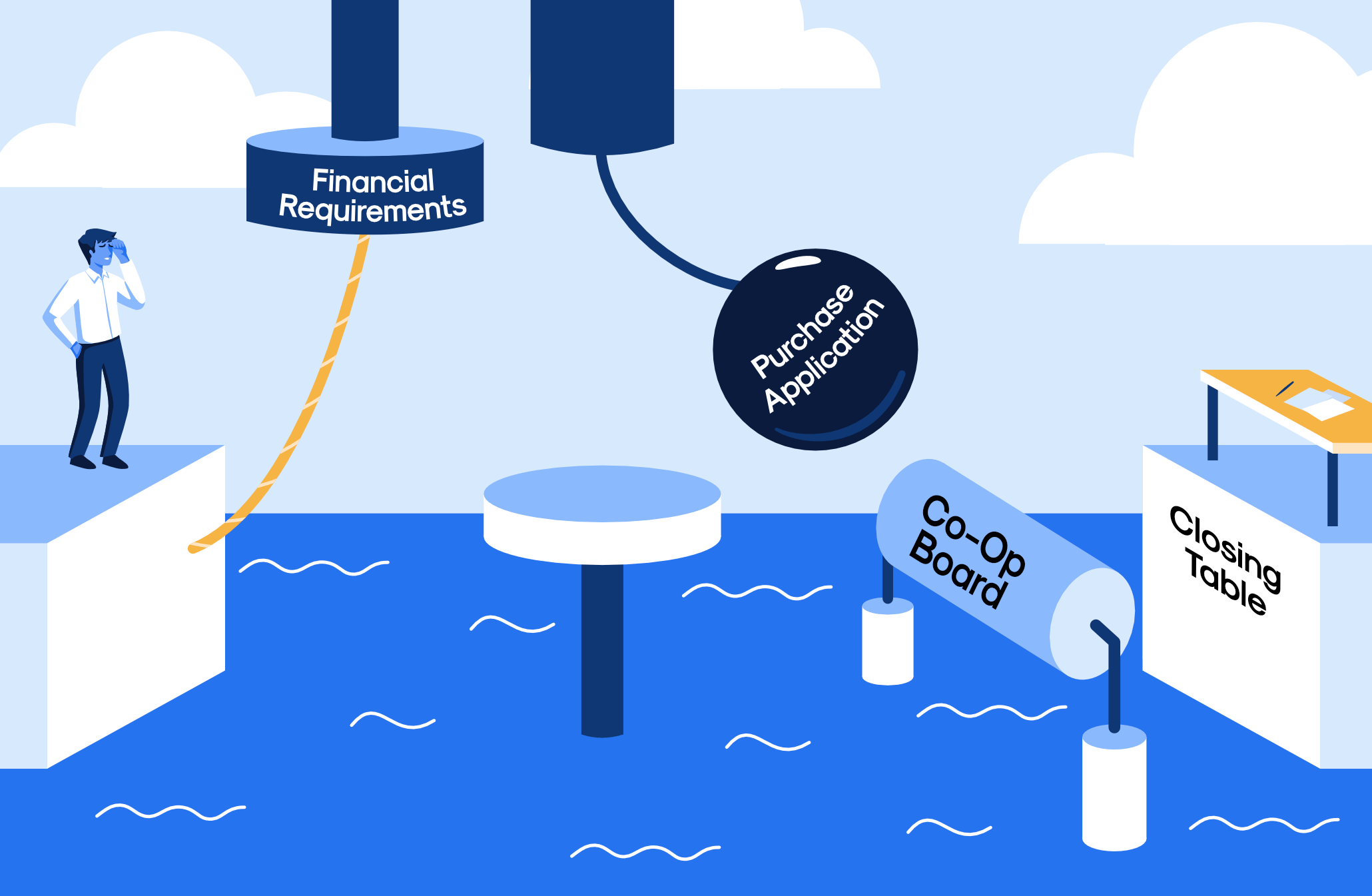

While there are some rare exceptions, investors should focus on condos. Co-ops often have restrictions on renting (or "subletting") which preclude them from being good investments. They will often limit how often you can rent out the property or restrict it entirely for a certain period of time after purchasing. For example, a common "sublet policy" is you can sublet for two out of five years and only after living in the unit for two years.

Condos are also easier to renovate and buy. Your potential buyer pool down the road will also be larger as foreigners are usually restricted to condos. For more information, check out our post on condos versus co-ops.

Can an investment property be depreciated?

Yes! Depreciation is one of the biggest benefits of investment properties. The value of the structure (as opposed to the underlying land) can be depreciated over 27.5 years. This can shield most or all of your rental income from taxes.

How does that work exactly? Let’s go through an example. Say you bought a condo for $800,000 and your share of the land under the building was worth $250,000. That means the apartment itself has a tax basis of $550,000. The IRS will let you depreciate that over 27.5 years or $20,000 per year.

Why is that a big deal? Say your rent the apartment for $3,000 per month and your common charges and other monthlies are $1,000. Your net rental income would be $2,000 per month or $24,000 per year.

But since you also have $20,000 of depreciation, your reported income will only be $4,000 per year! In other words, the investment property will bring in $24,000 of cash but only $4,000 of reported income!

Now there’s no free lunch. Depreciation is deducted from the amount you paid and lowers your cost basis. If you sell the property after eight years, you will have accumulated $160,000 of depreciation so the IRS will say your “cost basis” is $640,000. That will be used to calculate any capital gain.

Is investment property tax deductible?

Property taxes and any other expenses that are “ordinary and necessary” for an investment property are tax deductible according to the IRS. This includes expenses that would not be tax deductible for your primary residence.

Say your tenant calls because the refrigerator is broken. Since your tenant needs a working refrigerator, you would be able to deduct the repair. You wouldn’t be able to deduct that same repair if it was for your primary residence.

What are investment property mortgage rates?

When financing an investment property, you will generally pay about 0.5% more than you would for your primary residence. That could be higher or lower depending on the details of the transaction and your financial situation but it will almost always be higher.

You will also need to make a larger down payment for an investment property, often at least 20%.

Should you buy an investment property in an LLC?

As the name suggests, the benefit of purchasing an investment property in an LLC is to limit your liability. If someone injures themselves in the apartment and you own it in your name, they can come after you personally. However if the apartment is owned in an LLC, your exposure would be limited to the property itself.

Given NYC property values, being at risk of “just” losing the property is still significant and the accidents that could result in such a loss are rare but risk management is always important with investing!

An LLC also allows you to at least partially shield the identity of the actual buyer of the property.

There are drawbacks to purchasing investment properties in an LLC however. There are costs associated with forming and maintaining an LLC. Properties owned in an LLC are also never allowed to benefit from Cooperative and Condominium Tax Abatement should you choose to use it as your primary residence at some point.

In early 2019, politicians considered a pied-a-terre tax in NYC. What exactly qualified as a pied-a-terre was not well defined and there was talk that all LLCs could be subject to the proposed legislation. While not currently being discussed, this is a future risk to buying an investment property in an LLC.

Note: This article is meant to be informational and should not be used as tax or legal advice. If you have any questions about your particular transaction or situation, please contact your accountant or attorney.