One of the first steps in buying New York City real estate is picking an agent. Experienced? Check. Trustworthy? Check. Personable? Check. Do they offer rebates? Ummm, what?

If you've never heard of buyer agent commission rebates, you're not alone. They’re the big secret the real estate brokerage industry doesn’t want you to know about and can save you a ton of money. To be more specific, over the last six years, Yoreevo’s buyers have received an average commission rebate of $20,137 and over $11 million in total!

Those renovations you wanted to do? New furniture? A buyer rebate can go a long way towards paying for part or even all of that so let's make sure you get one!

How Are Real Estate Commissions Paid in NYC?

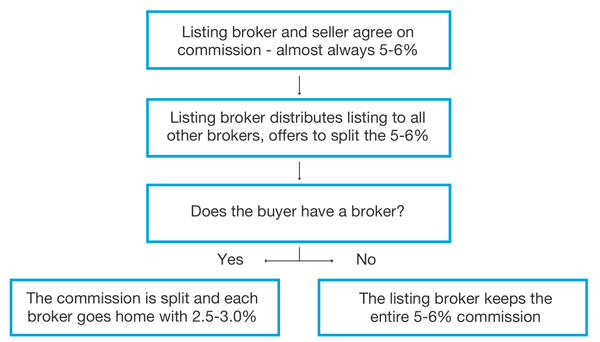

Before explaining how commission rebates work, you need to understand how commissions are paid. The system is a little complicated (by design) so bear with us.

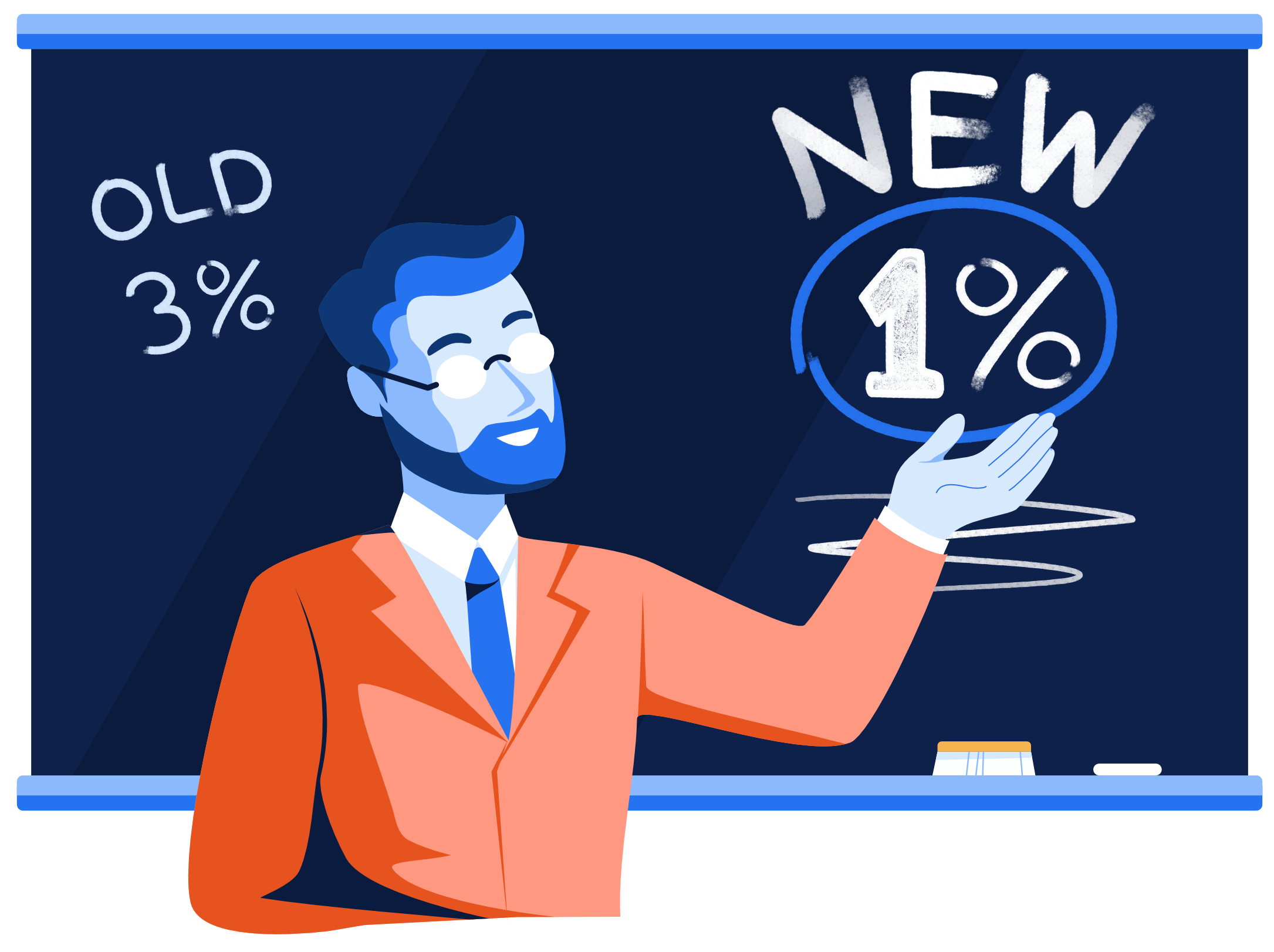

The first payment is from the seller to the listing agent. The seller agrees to pay a commission to the listing agent, most commonly 6% of the purchase price.

Then the listing agent turns around and offers to split that commission 50/50 with any buyer's agent. That's how your agent gets paid, usually 3% of the purchase price.

You'll often hear buyer agents say their services are "free." In a way, that's true. Buyer don't pay their agent directly but the buyer is the only one showing up to the closing table with cash so they effectively pay everyone. This misconception is great for real estate agents because buyers don't think twice about using one nor do they care about price. This is where commission rebates come into play.

What Are Buyer Agent Commission Rebates in NYC?

A buyer agent commission rebate is simply when a buyer's agent gives part of their commission to the buyer. In the chart above, it adds an additional step - your agent gives some of their commission to you!

The rebate can be any amount - that's between you and your agent - but Yoreevo's buyers receive two-thirds of the total commission.

These refunds are also called “commission rebates,” “buyer rebates,” “broker rebates” or "buyer broker rebates" and the mechanics are very simple. The buyer can either receive a check at closing or have it applied as a credit to the transaction.

Are Commission Rebates Legal in NYC?

Of course commission rebates are legal in NYC! Not only are they legal, the New York Attorney General's office encourages their use as a way to promote competition. Without them, a buyer can't control their agent's compensation - the commission offered is the commission paid.

For example, say you buy an apartment for $1,000,000 and there's a 3% commission. Your agent will receive a $30,000 commission - that much is certain - but by getting a rebate, you reduce your agent's compensation by that amount. In this case, a Yoreevo buyer would receive $20,000.

Commission rebates are legal across most of the country. There are a few states holding out but they're falling. For example,

- In 2021, Louisiana legalized commission rebates

- In 2022, Oregon made it clear that rebates can be applied as transaction credits

- In Iowa, their status isn't clear and but Iowa's Association of Realtors said in this 2021 interview that they're generally okay as long as they're disclosed

We don't know any good arguments for why a buyer shouldn’t be able to control their agent’s compensation. If you are in a state where commission rebates are illegal, call your representatives and ask. If they have a good answer, we'd love to hear it!

Are Commission Rebates Taxable?

The short answer is no. The IRS issued a private letter ruling in 2007 which treated a commission rebate as a reduction of the purchase price. If we take our hypothetical $1,000,000 apartment with a $20,000 rebate, the IRS would say you paid $980,000.

On a related matter, buyers often ask if they'll receive a 1099 for their commission rebate. Since the rebate is not considered income, they do not.

While a private letter ruling is not a universal rule, we are not aware of any commission rebates that have been taxed. That being said, it's always smart to check with you accountant.

How Do Agents Feel About Buyer Rebates?

To answer this question, we need to break the traditional broker community into two buckets.

Listing Agents: Any smart listing agent will realize that a rebate is great for them. What the buyer’s agent does with their commission doesn't affect them whatsoever. The listing agent's commission will be exactly the same and with a rebate, it's easier to get a deal done. Their $1,000,000 listing now only costs $980,000. Everyone wins!

Traditional Buyer Agents: Understandably, traditional buyer agents are sometimes threatened by commission rebates. Nobody likes making less money. In order to justify their high commissions, they often associate price and value with a lazy, "You get what you pay for" response. But does that agent do five-sixths of the work when their client wants to buy a property offering a 2.5% commission instead of 3%? "Of course not!" they'll tell you.

Rather than cling to the status quo, Yoreevo is embracing technology to reduce costs, increase efficiency and pass those savings on to our buyers.

How Do I Negotiate Buyer Rebates in NYC?

Any NYC real estate agent or brokerage can provide a buyer rebate. That being said, most agents don't want to reduce the commission. They may even be insulted if you imply they’re not worth the full commission.

An agent's brokerage can also be a problem. They often have minimum commission rates, eliminating the opportunity for their agents to provide a rebate.

The easiest approach is to work with a real estate brokerage that openly offer rebates like Yoreevo. That way, you’ll know exactly how much you’ll get back without any negotiation or awkward conversations. Yoreevo's business model is built on lower commissions so we're happy to have you as a client and get you a rebate!

Regardless of who you work with, make sure you get the rebate in writing to protect yourself and make sure everyone is on the same page.

Please note the total commission that is paid to a buyer’s agent is not negotiated. In NYC, all members of the Real Estate Board of New York (REBNY) and OneKey receive the same commission on a given listing.

What Are Some Possible Issues With Buyer Rebates?

The only issue you can potentially encounter with a buyer rebate is its affect on the loan-to-value (LTV) of your mortgage. If the rebate is not factored into underwriting, your LTV could be too high but as long as you tell your lender, everything will go smoothly.

For example, say you are buying a home for $1,000,000 and the bank requires 20% down. You’ll contribute $200,000 and borrow $800,000 - seems simple. However the rebates is generally treated as a reduction of the purchase price. If you’re getting a 2% rebate, the bank will now say you’re getting an $800,000 loan on a $980,000 purchase and your LTV just increased to 81.6% ($800,000 / $980,000).

While that may seem trivial, banks don’t budge on those ratios and it could cause issues for your transaction. The solution? Just tell your bank you’re getting a rebate! As long as they know, it’ll all be factored into underwriting.

Why Aren’t Buyer Agent Commission Rebates More Common in NYC?

More buyers are learning about commission rebates everyday but unfortunately most have no idea they exist! There are a couple reasons why.

Greed

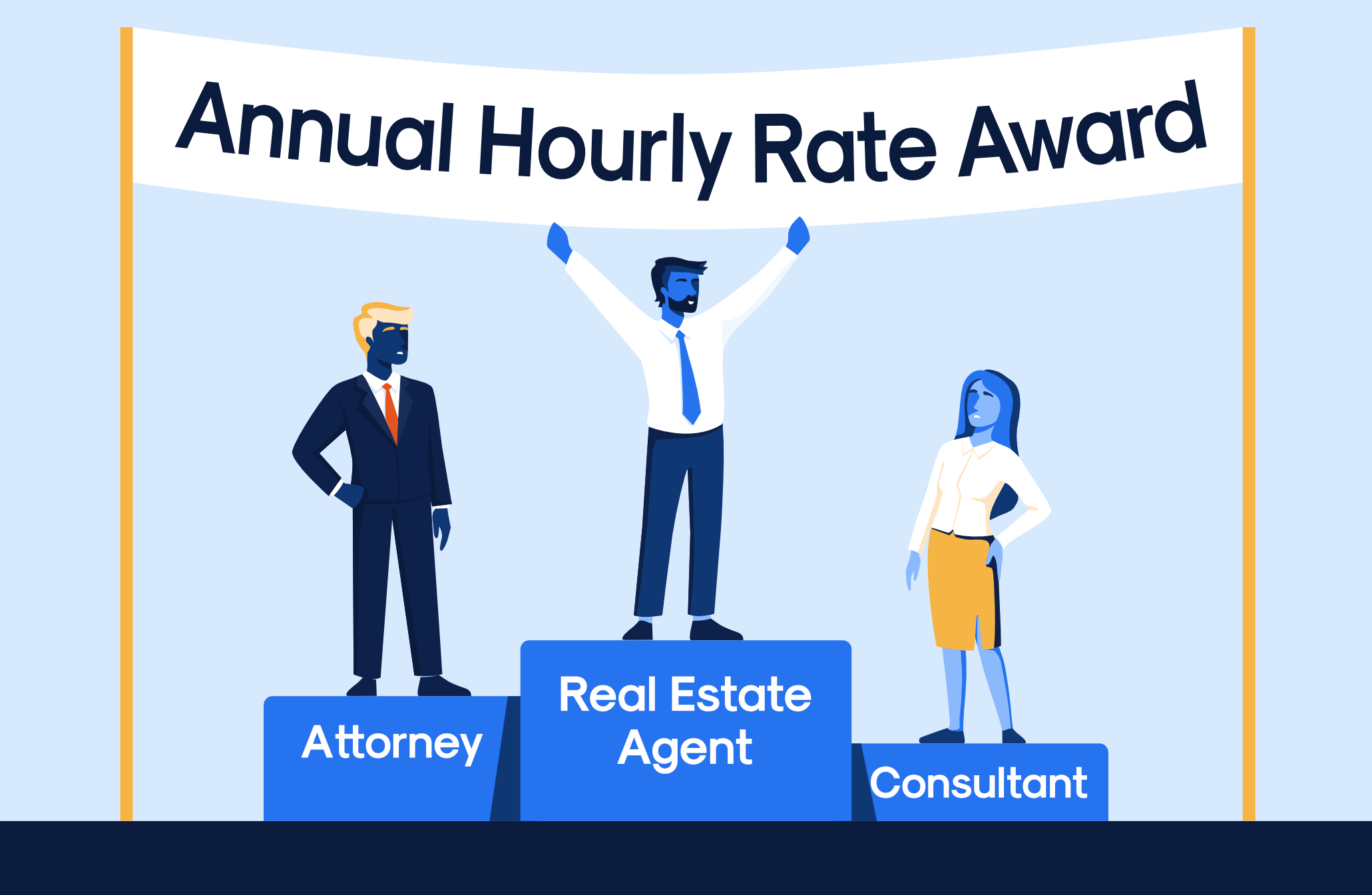

If your boss asked you to do 3x as much work for the same pay, you wouldn't be happy, even if you had received a 50% raise over the last ten years while doing less work.

That’s exactly what you’re doing by asking a "traditional" real estate agent for a commission rebate. Even though your transaction would remain extremely profitable, it’s easy for them to get comfortable and convince themselves they deserve $700/hour.

It takes a new entrant like Yoreevo to build a business around buyer agent commission rebates (and have more reasonable expectations!).

Transaction Size and Frequency

The best thing traditional brokers have going for them is NYC apartment purchases are large and infrequent. It's hard to be an expert in something you do every 5-7 years (the average holding period for NYC real estate).

First time buyers can be risk averse and mistakenly assume they must pay 3% for their broker. When Yoreevo speaks with repeat buyers, the conversations are much shorter. They know what a broker actually does and recognize a 3% commission is absurd.

Expense Structures

If you were charging more to do less, you’d do your best to keep that quiet. Brokers often try to change the subject by spending money on flashy but unnecessary expenses. Fancy offices, all day car services - buyers end up paying for these. This has locked traditional brokers into high cost structures that require high commissions and they couldn't offer rebates even if they wanted to.

Thankfully, you don't have to use a traditional broker and you are now an expert on commission rebates! If you've made it this far, we're pretty sure you'd agree everyone should get one so call us or email us at info@yoreevo.com and we'll get you on your way to a commission rebate!

Note: This post should not be used as tax advice. Please contact a qualified accountant if you have any questions about your particular situation.