If you're selling an apartment in NYC and not negotiating your broker commission, you’re leaving thousands of dollars on the table. While it was easy to believe the (false) claim that your agent was “free” when you bought, there is no sugarcoating it when you sell. Every dollar you pay your agent is a dollar out of your pocket so it's important to negotiate your broker commission.

Table of Contents:

How are NYC broker commissions typically structured?

Can you negotiate a NYC broker commission?

How to negotiate a broker commission when selling in NYC

Does a seller need to pay a commission to the buyer’s agent?

Lies agents will use to justify high broker commissions

How to sell with the lowest broker commissions in NYC

How are NYC broker commissions typically structured?

The first step in officially putting your apartment on the market is signing a “listing agreement” with your agent. The listing agreement is essentially a contract that outlines the terms on which you are hiring your agent. Before signing a listing agreement, you should read the entire document carefully. It's not a bad idea to have your attorney read it as well.

This is where you'll find the amount and structure of the broker commission. Usually it is structured as a flat percentage of the purchase price. Your agent will also agree to split the commission with the buyer’s agent, should they have one. That is a key detail and results in an even more egregious commission with direct buyers. More on that later.

Can you negotiate a NYC broker commission?

Broker commissions are always negotiable. Hard stop.

There is also no “standard” broker commission. 6% is most common but to say it is “standard” across the industry implies price fixing and can get a real estate agent in a lot of trouble.

In fact, in October 2023, two large brokerages and the National Association of Realtors were found guilty of colluding to inflate brokerage commissions and the jury awarded the plaintiffs $1.758 billion.

A 6% broker commission is also far from ubiquitous. It is only slightly more common than 5%.

Every broker is free to charge whatever they want. If someone tells you otherwise, they are lying.

How to negotiate a broker commission when selling in NYC

There are a couple ways you can easily negotiate down your broker commission.

Interview multiple agents

Interviewing multiple agents gives you options and leverage. You’ll also hear different pitches so you can compare each agent’s valuation of your apartment and the terms of their listing agreement.

When an agent knows they are in a competitive situation, they are much more likely to reduce their commission.

Ask your agent why they are worth their broker commission

Most agents justify their commission by saying that’s what they charge. Don’t let them off the hook that easily! Ask why 6% is the right amount. Why not 5% or 1% or 10%? We bet you'll get some interesting answers!

In reality, agents stick to 6% because that’s what they’ve always charged and sellers pay it. With rising property prices, that means agents make 50% more per transaction than they did ten years ago.

Push back on dual agency commissions

Dual agency is when an unrepresented buyer wants to purchase your property. This is also called a "direct" buyer. In this situation, your agent represents you and the buyer, becoming a “dual agent.”

Remember, your broker is charging a flat percentage and then if the buyer has an agent, it will be split with them. If the buyer is unrepresented, your agent will collect the whole thing. Listing agents love direct buyers.

This is arguably more ridiculous than the headline commission rate. Which do you think is more work for your agent?

- Find you as a client, take photos, post the listing, host open houses, accommodate private showings, negotiate the offer, etc.

- Put together the buyer’s purchase application.

In your typical listing agreement, with dual agency you're paying the same amount for both.

If your agent won’t reduce their commission in a dual agency situation, they’re either extremely slow at paperwork or being greedy.

An easy way to make this point is to ask how long it takes them to put together a board application. Then compare that to the incremental 3% they’re earning and ask if that seems reasonable. You will find they are easily asking for well over $1,000 per hour to organize documents.

If they maintain it’s an appropriate commission, tell them you’ll have Yoreevo represent the buyer for 1% (like we do all of our buyers).

Does a seller need to pay a commission to the buyer's agent?

A seller is not required to offer a commission (or "co-broke") to the buyer's agent. However, most brokers will not take your listing without one because it makes their job significantly more difficult and will likely result in a lower price.

In NYC, almost all buyer agents are paid a commission by the seller. The commission is advertised online so an agent knows how much they will be paid on each listing.

Very roughly, we would say 90% of NYC buyers have an agent and by not paying those agents, you dramatically reduce the size of your buyer pool. In order to mobilize the buyer agent community to sell your listing, almost all sellers offer to pay a commission to the buyer's agent.

Lies agents will use to justify high broker commissions

Yoreevo is a full service real estate brokerage which charges a total commission of 2-4% versus traditional brokerages at 5-6%. We do this by operating more efficiently, particularly in lead generation (like this blog post).

When traditional agents are interviewed against us, there are a few common lies they will tell the seller, in hopes they will continue to pay 6%.

“You get what you pay for”

By far, the number one cliché / lie is “you get what you pay for.” It’s easy to see the point they’re trying to make - since you’re paying less, you must be getting less.

But what if we flipped that around? Would you get more by paying more? Apparently not because a commission over 6% is virtually unheard of. How is it that every real estate agent is worth exactly 6%?

Looking at it another way, agents will routinely accept a 5% commission if it will get the seller to sign the listing agreement. But doesn’t that mean you’re only getting 5/6ths of the effort they would otherwise make?

So there’s a cap on broker commissions - you can’t pay more to get more - and paying less only gets you less if it's another broker. Hmmm...

"Your agent won’t be motivated with less than 6%"

We recently saw an article on another NYC real estate website explaining why you need to pay 6% to sell. It was essentially a collection of quotes from real estate agents and one in particular caught our attention -

“[Your agent] might only sell two apartments per year, so naturally, they'll pursue - and devote more effort to - the jobs that will pay the best commissions.”

Believe it or not, that datapoint is true. The average NYC real estate agent only does two deals per year. These agents must be exceptionally slow because it doesn’t take six months of full time work to close a transaction.

We can’t quite square this hypothetical agent who will run through walls for your listing but is also content with just two deals per year.

How to sell with the lowest broker commissions in NYC

What’s the best way to negotiate a lower broker commission in NYC? By not negotiating at all!

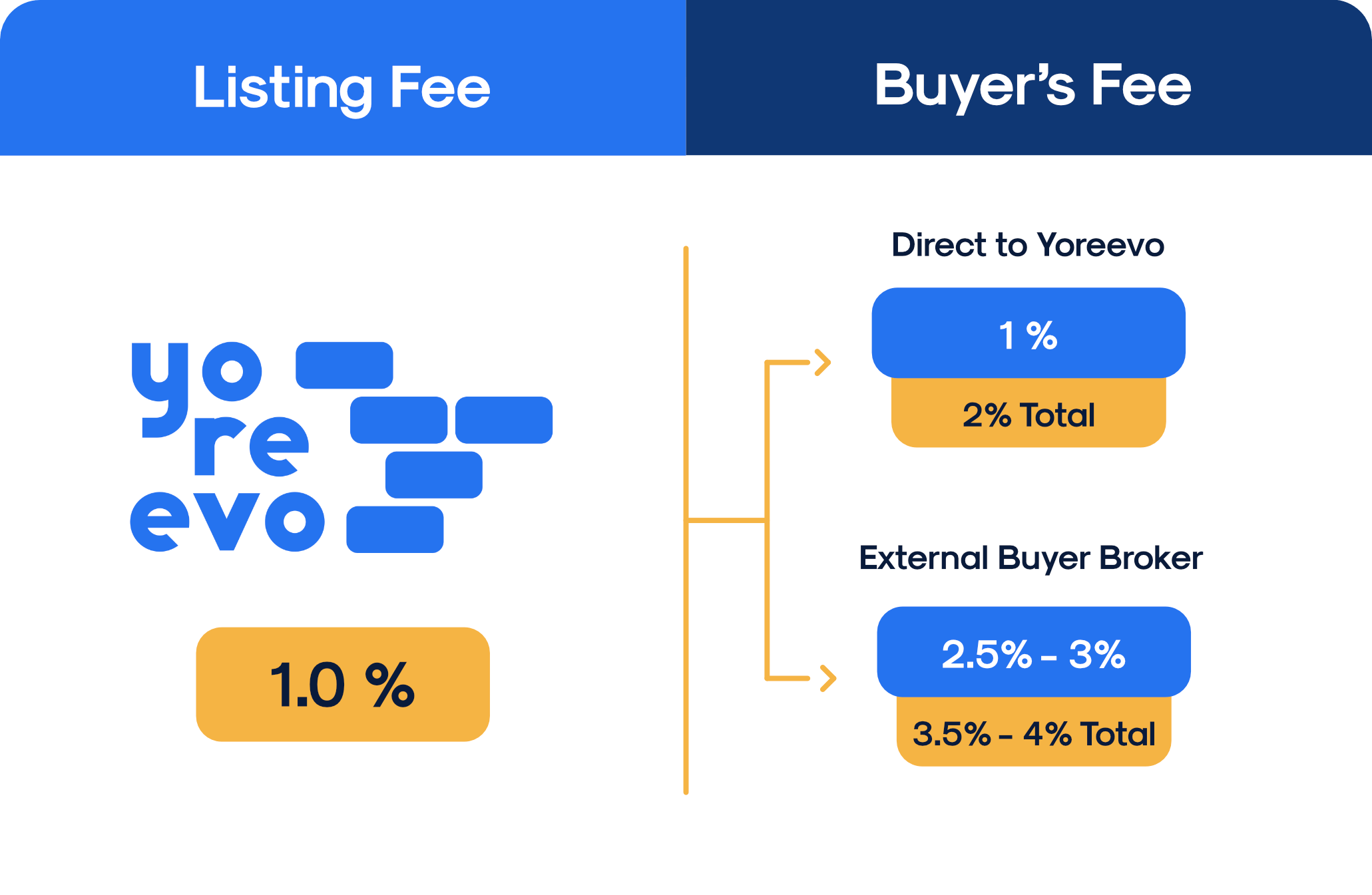

Yoreevo offers full listing service for a 1% commission when you also buy with us (1.5% if you only sell). Your all-in broker commission, including the buyer’s agent, will be 2-4% versus 5-6% with a traditional brokerage.

Agents will make up all kinds of lies to maintain the status quo and honestly we love hearing them. After you talk to an agent who insists 6% is necessary, contact Yoreevo and we’ll explain how our modern approach can save you a ton of money!

You can also email us at info@yoreevo.com or call us at 212-365-0151.

Note: 1% listing fee assumes that you also buy with Yoreevo within 365 days before or after your sale. If you only sell, the listing fee is 1.5%. Minimum commissions apply.