Here are answers to some of the most common questions we receive. Have others? Want to talk through it? Give us a shout!

Down Payment

Buyer closing cost calculator in NYC

Mansion Tax

$-

Your Attorney

$-

Title Insurance

$-

Application Fees

$-

NYS/NYC Transfer Tax

$-

Seller's Attorney

$-

Financing Fees

$-

Mortgage Recording Tax

$-

*︎The estimate above is just that, an estimate. Actual buyer closing costs will vary. You should always consult an attorney regarding the closing costs when considering a purchase or sale.

A graduated tax paid to New York State by the buyer on purchases $1,000,000 and up. The tax starts at 1% of the purchase price and increases to a maximum of 3.9% for purchases $25,000,000 or more.

The mortgage recording tax applies when buying a condo or house (real property) but not a co-op (personal property). The tax percentage is based on the amount of the loan and increases at $500,000 where the buyer’s share is 1.925%. Given most buyers take out an 80% loan to value mortgage, this is usually the largest buyer closing cost. You can potentially reduce your mortgage recording tax with a CEMA.

Both New York City and New York State charge a transfer tax when you sell real estate. The NYC transfer tax goes from 1% for properties $500,000 and under to 1.425% when over that amount. New York State also charges 0.4% for all sales under $3,000,000 and 0.6% for those $3,000,000 and over. On resales, transfer taxes are paid by the seller while on new development, the buyer is expected to pay (although this is negotiable).

While technically an optional buyer closing cost, almost all buyers purchase title insurance. Lenders require it to protect their collateral and most attorneys will require an owner’s policy as well. Title insurance protects you in case a problem with the title is found after closing. Such problems can range from small mechanic’s lien to buying the property from someone who didn’t actually own it. Title insurance only applies when purchasing a condo or house. Co-ops do not require title insurance.

Real Estate Attorney

Most NYC real estate attorneys will charge a fixed fee of $2,000 to $3,000 for a basic purchase transaction. If the transaction gets more complex, your attorney fees will increase. For example, a sale leaseback or CEMA could add $1,000 to your legal bill. If you are buying new development, the sponsor will expect you to pay for their attorney as well. This is negotiable, especially in a weaker market.

Application Fees

In condos and co-ops, the management company will charge various fees when you submit the purchase application. These are usually $500 - $1,000 and vary at each building. In most larger new developments, you will also be required to pay for a portion of the resident manager’s apartment. Before submitting an offer, you can ask for a copy of the purchase application or offering plan which will outline all of these fees. There is often a refundable move in deposit as well. There are no application fees when buying a house.

Financing Fees

If getting a mortgage, your bank will pass on fees for the lending application, appraisal, credit check and the bank’s attorney. These usually run about $2,000.

New Development Closing Costs

In addition to the sponsor’s attorney, new development buyers are expected to pay the transfer taxes. Transfer taxes are significant as they usually 1.825% of the purchase price. If you are buying a condo, you will also be required to make a working capital contribution. This is to fund the building’s bank account so it can pay its bills. You may also be required to contribute to the superintendent’s apartment and other miscellaneous fees. Be sure to ask for all buyer closing costs prior to making an offer on new development as they can be significantly higher than a resale.

Do you want to know more about rebates?

When and how do I get my rebate?

So I get full service AND a commission rebate?

Is the commission rebate taxable?

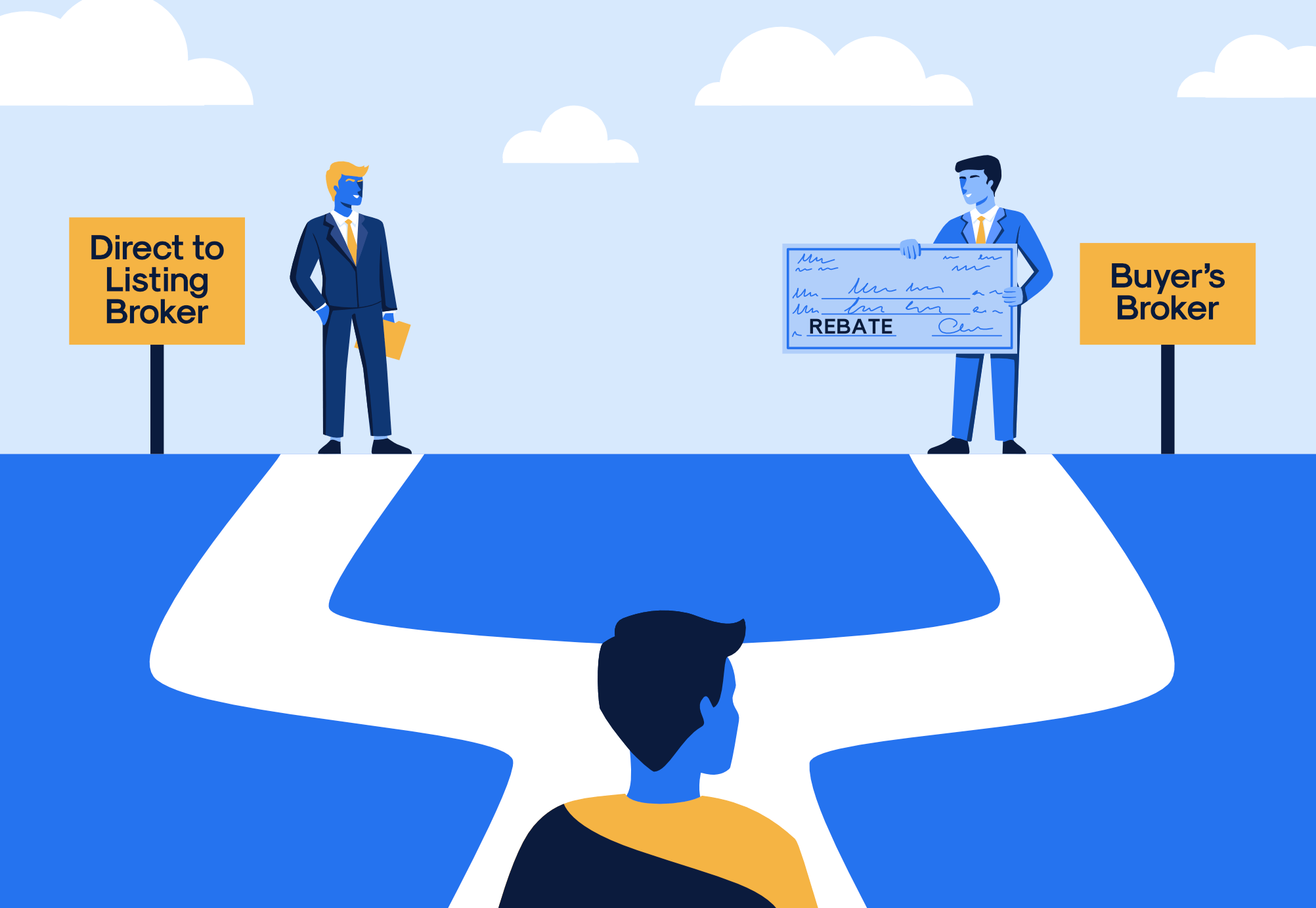

Why do I need Yoreevo? Can I go directly to the listing broker and get the entire commission?

How do commission rebates work?

NYC Buyer Agent Commission Rebates - The Authoritative Guide

Why Should You Use A Buyer’s Broker And Not Go Direct?

How Does A Buyside Broker Get Paid And Why?

More blogposts

Save thousands, buy with Yoreevo.

browse listings